Geopolitical tensions and economic uncertainty have caused significant volatility in financial markets recently. Recently, President Donald Trump has attracted attention again and made comments on U.S.-China relations and the Federal Reserve. Trump’s latest speech is known for his ability to swing the market, triggering a green wave across the entire trading screen and even promoting cryptocurrencies.

Trump’s latest move

The U.S.-China trade conflict has escalated sharply, and President Trump imposed a 145% import tax on Chinese goods. China responded quickly, imposing 125% tariffs on U.S. products, exacerbating economic conflict. As a result, stock prices have faltered and interest rates on U.S. debt have risen due to investors’ concerns about slow economic growth and increasing inflationary pressures.

Learn more: Trump tariffs drive miners out of the United States

“We are good to China” in a recent interview, which shows a positive view of the situation. He also suggested the possibility of adjusting import tariffs on Chinese goods, clarifying that while tariffs won’t be lowered to 0%, they will be significantly lower than the 145% interest rate that previously shocked the market.

according to guardianThe president also said he had no plans to dismiss Fed Chairman Jerome Powell. A few days after he posted on social media that Powell posted on social media, his comments were removed because they did not lower interest rates faster.

Source: Guardian

Bitcoin rally: Trump effect

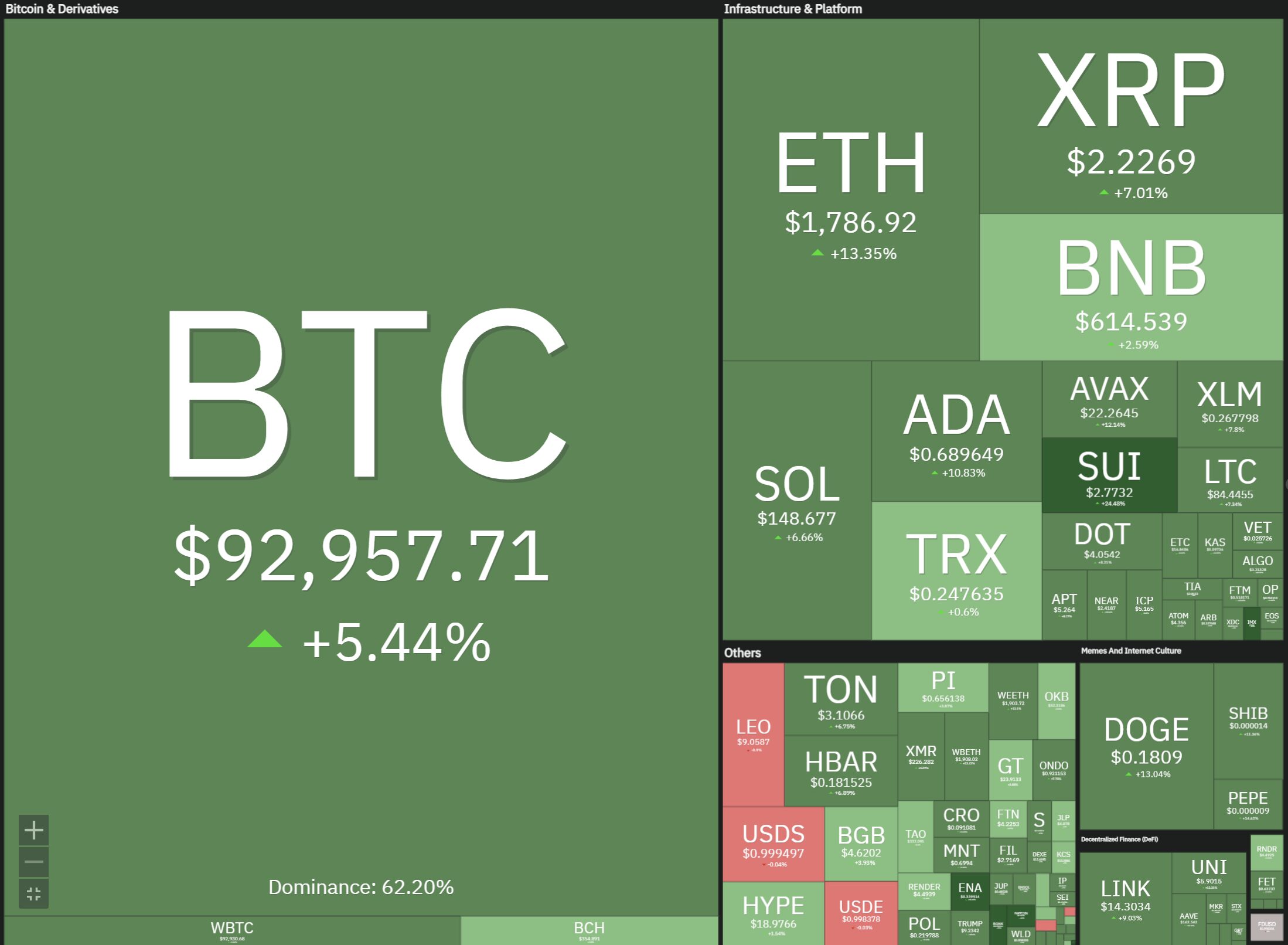

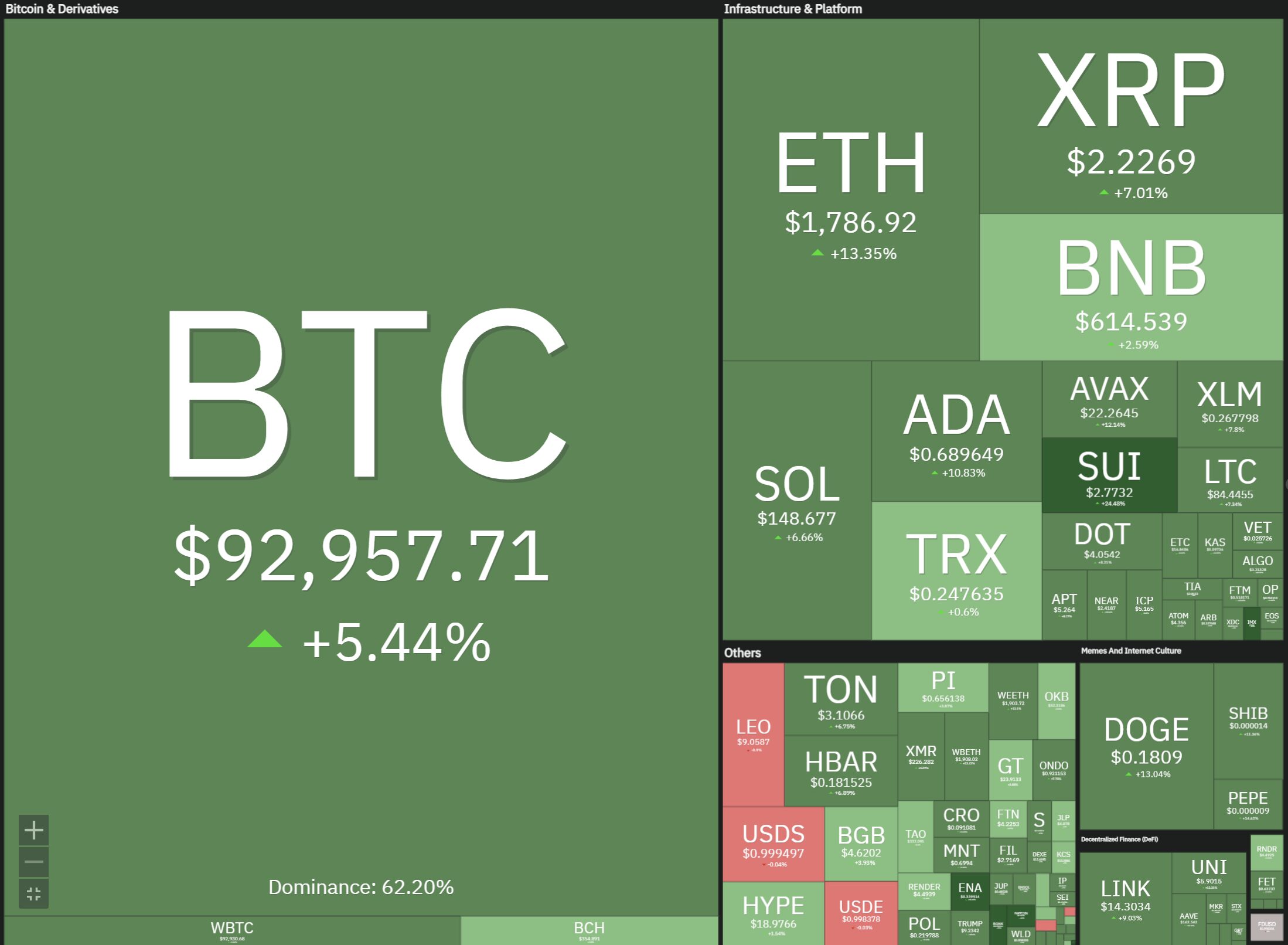

Trump’s rhetoric sparked cryptocurrency market rally, with Bitcoin soaring to $93,000. Ethereum and other altcoins also jumped on the optimistic wave. As investor confidence rebounded, Trump’s optimistic signal rebounded, and the overall crypto market cap grew nearly 5.9%, surpassing $29.1 trillion.

Source: COIN360

In addition, the unprecedented net inflow of $9.1112 billion was recorded according to records of institutional heavyweights, the highest net inflow since Trump’s inauguration. Trader t. Notable inflows include $267.1 million inflows to ARKB at ARK Invest, followed by Fidelity’s Wise Origin Bitcoin Fund (FBTC), its $253.82 million, and Blackrock’s Ishares Bitcoin Trust (IBIT), $192.08 million.

4/22 Bitcoin ETF Total Net Traffic: $911.2 million

(The highest inflow since Trump took office)$4 (BlackRock): $192.08 million$ fbtc (Fidelity): $253.82 million$ bitb (Position): US$76.71 million$ arkb (Ark Investment): US$267.1 million$ btco (Invesco): $18.27 million$ ezbc (Franklin):…https://t.co/dxaa4m6lew pic.twitter.com/nm7g5c1mpe– Trader t (@thepfund) April 23, 2025

This institutional buying frenzy cuts the revolving supply of Bitcoin, driving its price rally. With more possibilities in ETFs, Bitcoin’s upward trajectory may continue, consolidating its role as a global financial asset.

But with the conflict of trade policy details and uncertainty in the future, this is not all sailings go smoothly. Investors should keep their eyes open for changes with China, otherwise the Fed can quickly flip the script. Currently, Outlook is bright, but the long game is still in the air. Diversity and staying on the headlines, this is probably just the smartest game on this wild ride.