With the expansion of blockchain technology, new mechanisms have emerged to enhance Security, scalability, and financial opportunities in a decentralized network. These advancements allow you to actively participate in shaping the future of finance and receive rewards while supporting cutting-edge systems.

This guide will explain what reproduction is, how it differs from piles and what it is for in terms of cryptocurrency. In addition to the feature layer, it will also cover liquid reproduction tokens, security issues and top-level protocols.

What is cryptocurrency?

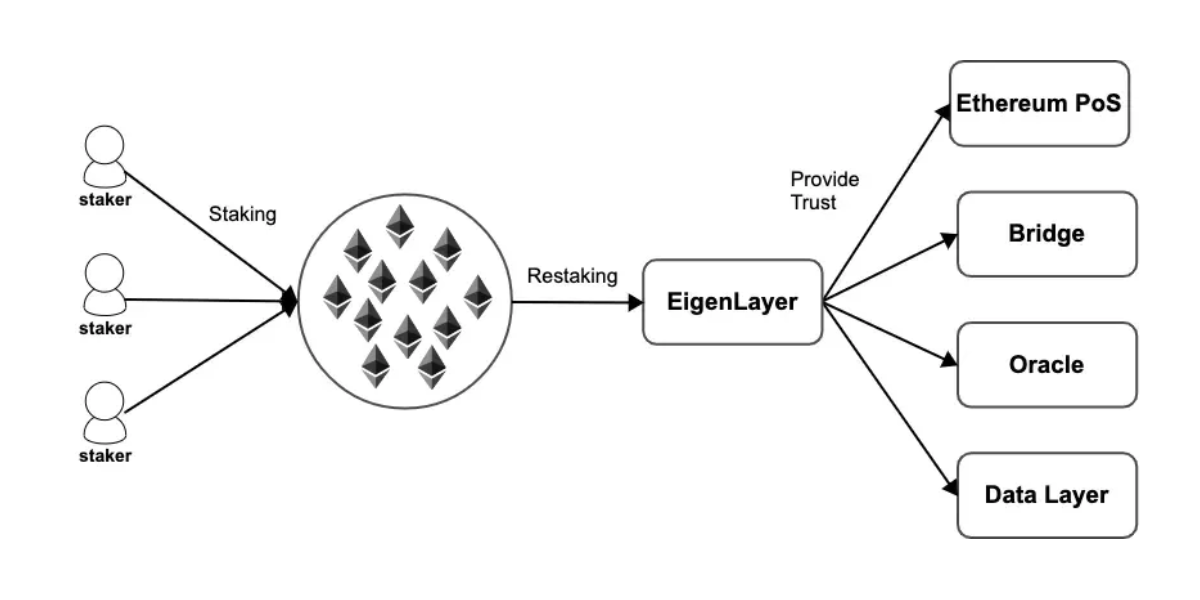

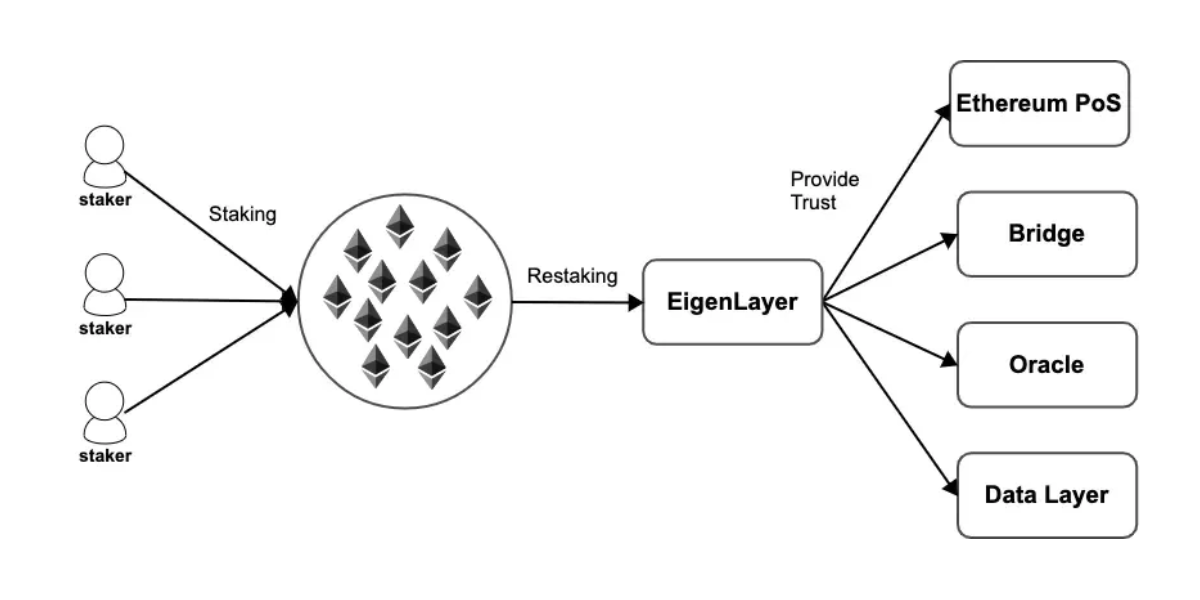

Restarting in cryptocurrencies means you can use fixed tokens to secure other blockchain protocols. In a verification system like Ethereum, you need to lock the token to verify the transaction and get rewards. Restaking allows you to use these fixed assets at the same time to support other networks. Platform likes eigenlayer Lead this innovation. Here you can improve blockchain efficiency without tearing down the original shares.

How does reproduction work?

Recover functions through two methods: Local and liquids are restored. In native recovery, you operate an Ethereum node and add software to place the token on the secondary protocol. This requires technical skills and risk reduction acceptance, and the network will violate your funds.

The liquid re-acting simplifies the process. you can Pile crypto assets Use a validator and receive liquid hiding tokens (LSTs) representing your shares. You then relist these LSTs on platforms like Eigenlayer to ensure other services and keep your assets liquid.

Smart contracts manage the security and speed of these transactions. You must choose a service that is proactively validated (AVSS), such as Oracle Networks or Sidechains, to support and earn rewards based on your contribution.

Reproduction can also improve network security and bring you more rewards. It allows other networks to use Ethereum’s security and can help you earn more from the same cryptocurrency.

Why is reproduction important?

Restoring increases trust, security and return in the blockchain ecosystem.

- Higher rewards – You can earn more by reproduction without new tokens.

- Better security – It helps ensure new blockchain services.

- Capital efficiency – It is used for many purposes.

- Network Growth – It supports more projects without the need for new validators.

Reproduction type

1. Local recovery

In native recovery, you directly manage the storage assets to support other networks. You need to run an Ethereum validator node that requires technical skills to set up and maintain. You must install dedicated software (such as Eigenlayer’s) to extend fixed tokens to protect other protocols such as Sidechains or data availability layers. This process allows you to maintain your original stake on Ethereum while receiving rewards from the auxiliary network.

Some rebuild platforms that support this Solayer, Solv, Bouncebit and Swell. They allow you to regain your assets through a variety of services and earn rewards by helping secure different parts of the blockchain ecosystem.

2. Liquid reproduction

Liquid reproduction provides a simpler and easier to obtain. You store the assets in the Ethereum Verifier and receive Liquid has token (LSTS), representing your mark. These LSTs remain tradable, giving you flexibility. You then re-identify these LSTs on platforms like Eigenlayer to ensure active validated services (AVSS).

Some liquid revision platforms include Ether.fi, Kelp Dao and Renzo. They allow you to restart LST and earn more from the same fixed assets.

The highest rehabilitation protocol

1. eigenlayer

eigenlayer is a leading reproduction protocol built on Ethereum that allows you to re-recover fixed ETH or liquid hiding tokens (LST) to secure other applications called Abioned Service Services (AVSS).

You can get extra rewards by extending Ethereum’s crypto-economic security to sidechains, Oracle, or scrolling. You can use an LST like STETH to participate by reproduction by native, running a validator node, or liquid reproduction.

2. Rope back

Solayer is the first reproduction protocol for Solana natives. It enables you to redefine the SOL token to ensure a variety of applications and services. Solayer supports both Endogenous AVS (built inside Solana) and exogenous AVS (external services). By remastering, you can get yields from multiple incentive layers.

3. Babylon

Babylon It is a re-engineering protocol that incorporates Bitcoin’s security into the Proof of Commodity (POS) blockchain. You use BTC to ensure that your POS network, aggregate or application can earn profits without packaging or bridging assets. Babylon uses a Cosmos-SDK-based protocol that emphasizes user control and liquidity.

4. Ether.fi

Ether.fi is a liquid re-engineering scheme about Ethereum that allows you to carry ETH and receive Eeth, liquid re-production tokens. You can regain EETH on platforms like Eigenlayer or Symbiosis to ensure AVSS and get more complex rewards.

5. Symbiosis

Symbiosis is one The licenseless reproduction agreement for Ethereum, Unlike Egenlayer’s ETH focus, any ERC-20 token is supported. You will re-identify assets such as Steth or Stablecoins to ensure a customizable network, select operators and cut conditions. Its modular design and non-escalable contracts enhance decentralization and reduce governance risks.

How to restore ETH and other cryptocurrencies?

Step 1: Select one to put into the platform

Choose first The best encrypted egg Where can you use cryptocurrencies like ETH or someone else. For ETH, Eigenlayer or Ether.fi is a good choice because they give you liquid tokens, such as Steth, which you can use for reproduction.

Step 2: Set up an encrypted wallet

Next, get a wallet that can be used with the platform of your choice. MetAmask is popular for ETH because it is secure and can be easily connected to most stacked and reproduction sites. If you use other coins, you may need a Phantom for Solana or Keplr to implement a cosmic-based chain.

Download the wallet, write down your private keys, and store them safely – never share. Add a small amount of cryptocurrency to cover transaction fees, such as gas on Ethereum.

Step 3: Bet on your cryptocurrency

Now use the platform to store your cryptocurrency. For example, on Lido, you connect your wallet, choose how much ETH you want to leverage, and then confirm the transaction. In return, you will receive a liquid token representing your shares, such as Steth. This step is key, as these tokens are the methods you will use to reproduction. Make sure you understand any lockdown periods or risks.

Step 4: Find Re-form Agreement

Once accumulated, look for a re-engineered agreement to earn additional rewards. For ETH, Eigenlayer is a common choice that allows you to support other networks using Steth.

Step 5: Store on the re-equipped platform

Once the protocol is selected, place the liquid token to begin reproduction. For example, in Eigenlayer, you can connect to your wallet, select steth, and then approve the deposit via the transaction. Check terms such as payment method or whether there are exit restrictions. This step activates your reproduction and allows your tokens to earn more across multiple networks.

Step 6: Track your shares

Finally, keep an eye on the funds you have arranged. Most platforms have a dashboard that shows your rewards and any risks, such as validator issues that may cost you. Log in regularly to see how your shares work and whether you need to manually request rewards.

What are the benefits of reproduction?

- Higher rewards:RESTAKING allows you to earn additional revenue by using the same fixed encryption (such as Ethereum) across multiple blockchain networks. For example, you might get 3-4% from the static situation of Ethereum, plus 1-5% of protocols like eigenlayer.

- Save capital: Recreate your existing shares, rather than locking new funds for each network. This raises funds for other investments, which is especially useful for those with limited funds.

- Strengthen the network: By re-made, you can help protect smaller or newer blockchains, making them harder to attack. More powerful network value growth has the potential to enhance your markup.

- More flexible: Liquid reproduction provides you with tradable tokens that can be used for fixed assets. Unlike traditional equity (usually where funds are locked), you can sell or use these tokens at any time.

Risk of reproduction

- Smart contract error: Reproduction usually relies on complex smart contracts. If there is an encoding error, it may be lost or stolen. For example, hacking attacks in the DEFI protocol resulted in billions of dollars in losses.

- Reduce penalties: If you closely associate a validator with misbehavior or offline, you may lose a portion of your shares. In Ethereum, the cuts could be 1-100% based on violations.

- Market fluctuations: Rest assets, especially liquid tokens, may fluctuate in value. A market crash may eliminate your points rewards or reduce your principal even if the agreement is working properly.

- Risk of overexposed: Recovering the same asset in multiple networks increases your dependence on a cryptocurrency. If the asset (such as Ethereum) goes sharply, your losses will breed in all protocols.

- Agreement failed: The smaller network you reuse may fail due to lower adoption or technical issues. If they crash, your reward or funds tied to them may disappear.

The future of recovery

As blockchains become more connected, the future of resuming production seems to be bright, but it will depend on the rewards when making the rewards worth the risk and remain stable. As more and more people join and platforms like Eigenlaylayer grow, Restaking can change the way decentralized finance works, but its success depends on its success, but it depends on its scope, its scope, how many people embrace and risk.

Reproduction will make the blockchain work together. You will use a single equity to protect different systems (such as Sidechains, croulps, or Data Networks) and connect them smoothly. This creates a shared security system that enables Ethereum’s strong foundation to help new projects. You will help small startups start faster because they don’t need to create their own validator groups, which inspires more creative applications.

Despite this, there are still obstacles to clear. Punishments from bugs or flawed validators in smart contracts can scare people, so we need stricter security, such as better checks or safety nets, to maintain higher trust. If these problems are in trouble, some may be avoided. The rise of tradable reproduction tokens is exciting because they allow you to cash out or reinvest without getting stuck, and these may grow.

in conclusion

In short, Restaking changes cryptocurrencies by letting you secure multiple blockchain networks with fixed tokens, increasing efficiency and rewards. With protocols like Eigenlayer, Solayer, Babylon, Ether.fi, and Symbiotic, you can access native or liquid re-carrier to support a wide range of applications from carapace to rolls.

FAQ

What is the difference between stillness and remake?

Staking involves locking your cryptocurrency (such as ETH) to verify transactions that validate blockchain and get rewards. Remake remakes by letting you use those fixed tokens to ensure other networks (such as Sidechains or Oracles).

You won’t cancel your assets; instead, you extend their utility. Staking supports one blockchain, while reproduction supports multiple blockchains at the same time.

Is it safe to revise cryptocurrency?

Restaking Crypto poses risks and is not 100% safe. You will face cuts and the network will fine your funds for validator errors or downtime. A smart contract error or a protocol failure can also threaten your assets.

What is a liquid reproduction token?

Liquid Reproduction Token (LRTS) represents your fixed assets in the Restaking protocol. You can store ETH using a validator and get LRTs like Eeth, which can stay tradable. You re-identify the LRT to ensure other networks while maintaining mobility. LRT allows you to get rewards without locking in funds.

What is the purpose of reproduction?

Restaking is designed to maximize the efficiency of your storage assets. You can protect multiple blockchain networks with one share. This can improve your rewards without additional investment. Remastering also enhances new projects by sharing Ethereum’s security.

What other re-engrafting agreements besides eigenlayer?

In addition to eigenlayer, Solayer Supports Solana-based link repair for chain chain protocol. Babylon Allows you to reuse Bitcoin to ensure verification of the network. ether Liquid reproduction of tradable Eeth tokens.