$Aergo stood out from the Binance Spot Market on March 28, 2025, with activity on Upbit and Binance Futures 10x to $0.57, which showed significant resilience. The price of $ARDR (280%) and $ARK (60%) rose sharply in Binance’s April “Vote for Delist” campaign, a surprising turnaround highlighted how Binance’s surveillance tags and downgrade events create volatile, high-risk, high-risk, high-risk, high-risk, high-risk, high-risk, high-risk, high-risk, high-risk, high-risk, high-risk, high-risk, high-risk, high-risk landscapes for traders.

$Aergo’s price rebound

On March 21, 2025, Binance announced the spot market for Aergo, which has dropped 6% to $0.06845 since March 28. While most elaborate coins tend to fade into obscurity, $Aergo is a native token for a hybrid blockchain platform powered by Samsung’s Blocko, which manages to go against expectations. After being distinguished by Binance, Aergo $Aergo soared 10 times to $0.57 for $920 million before regaining Binance Futures.

Compare this activity to other Delist delist tokens deleted on April 16, 2025. They plummeted and $Cream lost its obvious market cap.

Aergo’s edge? High UPBIT volume continues to liquidity, 9/4 of US$250 million, if there is US$250 million Gem detectorturning tilted immersion into speculative fanaticism. Traders who discovered this pattern in Korean exchanges caught the huge wave, proving that not all stand out was doomed.

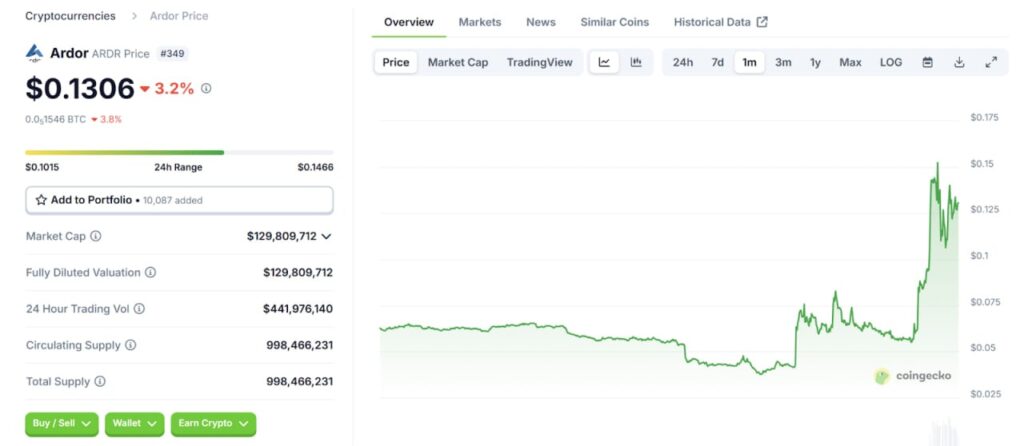

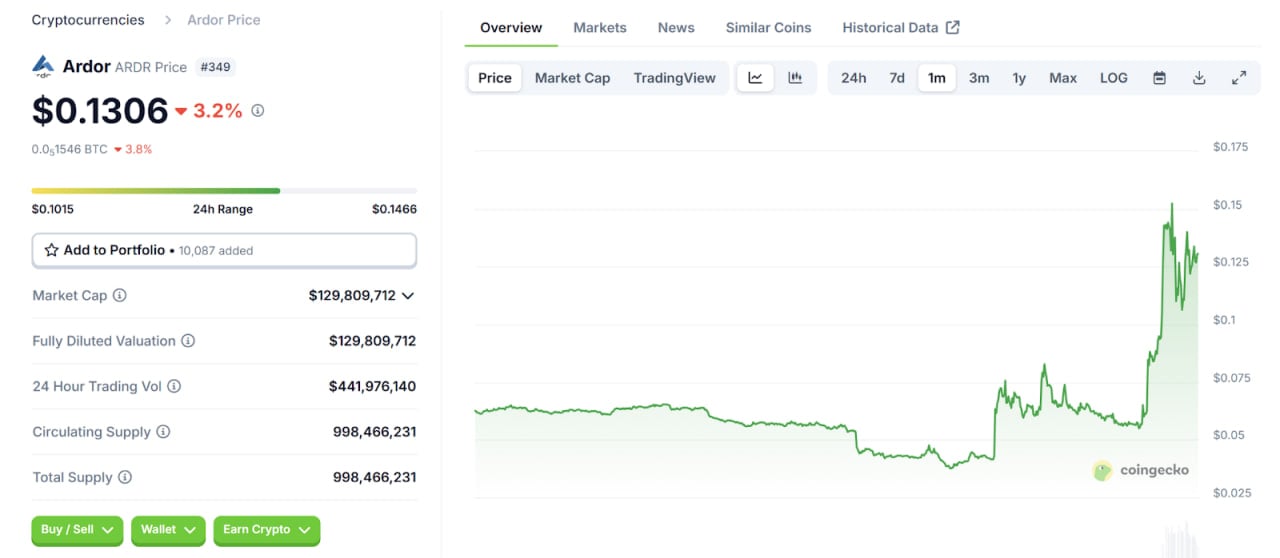

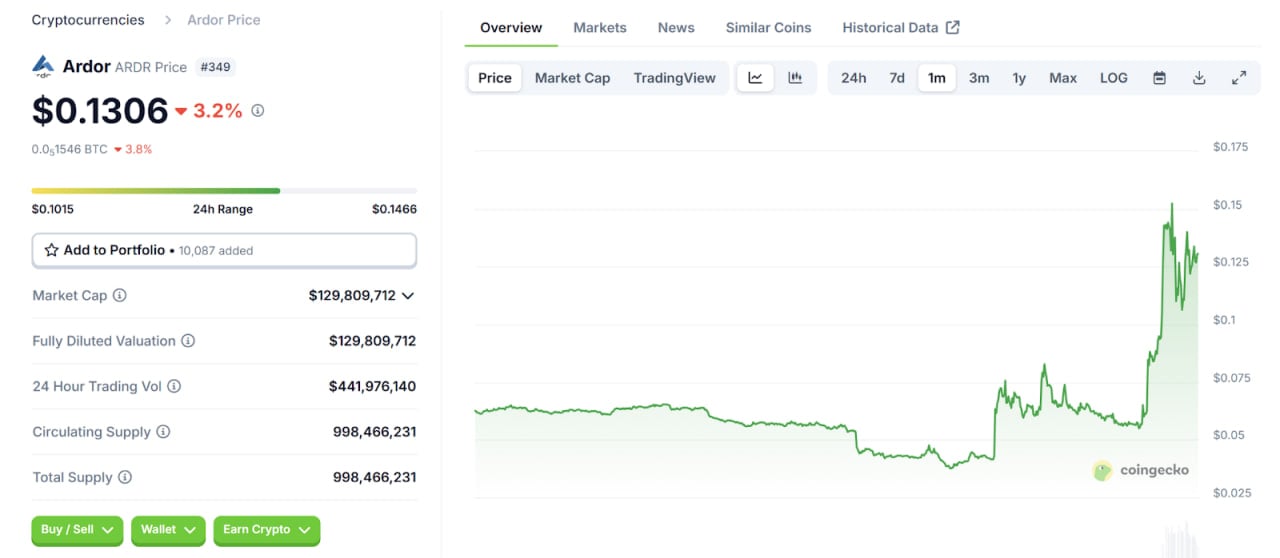

Parallel soars of $arddr and $ark

$ardr and $ark played similar scripts, included in the second “Vote for Drister” campaign from April 10-16, 2025. Despite receiving 3.6% and 5.8% votes, neither $arddr and $ark have confirmed that their prices have increased significantly.

Source: Coingecko

Unlike other tokens The second batch of “voting” Like $PDA and $voxel, $ARDR $ARDR surged 280% to $0.15 on April 16 with sales of 1,100%. $Ark, less dramatic, could climb to $0.52, up nearly 60%. Both tokens are favorites for traders on Bithumb, where high trade volumes can maintain liquidity. Similar to the UPBIT-driven rally of $Aergo ($250 million in volume on April 9), Bithumb’s Ardr/KRW and ARK/KRW Pairs have huge events.

However, the hype has not continued. $Aergo knocked 63% to $0.18 in 24 hours. $ardr may drop 10-15%, while $ark stagnates or slides slightly. These corrections highlight the volatility of the Delist-driven pump. Traders chasing news is often affected when momentum fades away, especially if the project lacks strong fundamentals.

Take advantage of Binance’s risk indicators

Through the above case, Binance’s surveillance tag can be considered as a gold mine for merchants. These flags mark the risk that could arise due to low liquidity, weak development or regulatory red flags.

Voting for the campaign ended April 16 will amplify the fluctuations, creating a pump and lowering the settings. To capitalize, track the marked coins through binary announcements and check the BitHumb and Upbit amounts on CoinMarketCap or Coingecko. The surge like $aergo, $ardr and $ark are usually before the rally.

Don’t forget to stay proactive: Monitor Binance Square for volume clues to Delist updates and Korean Upbit and BitHumb Exchange data. $aergo, $arddr and $ark show what is possible, but timing and risk management are everything.