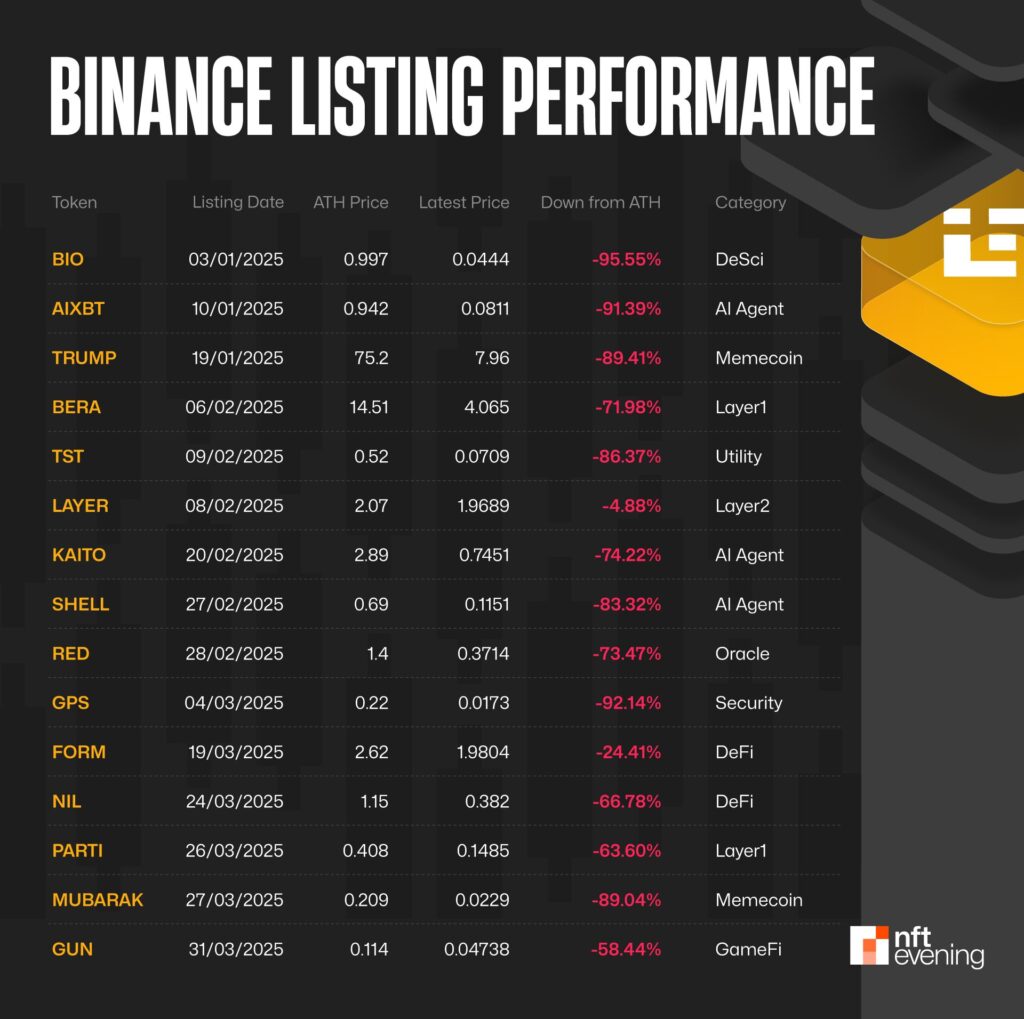

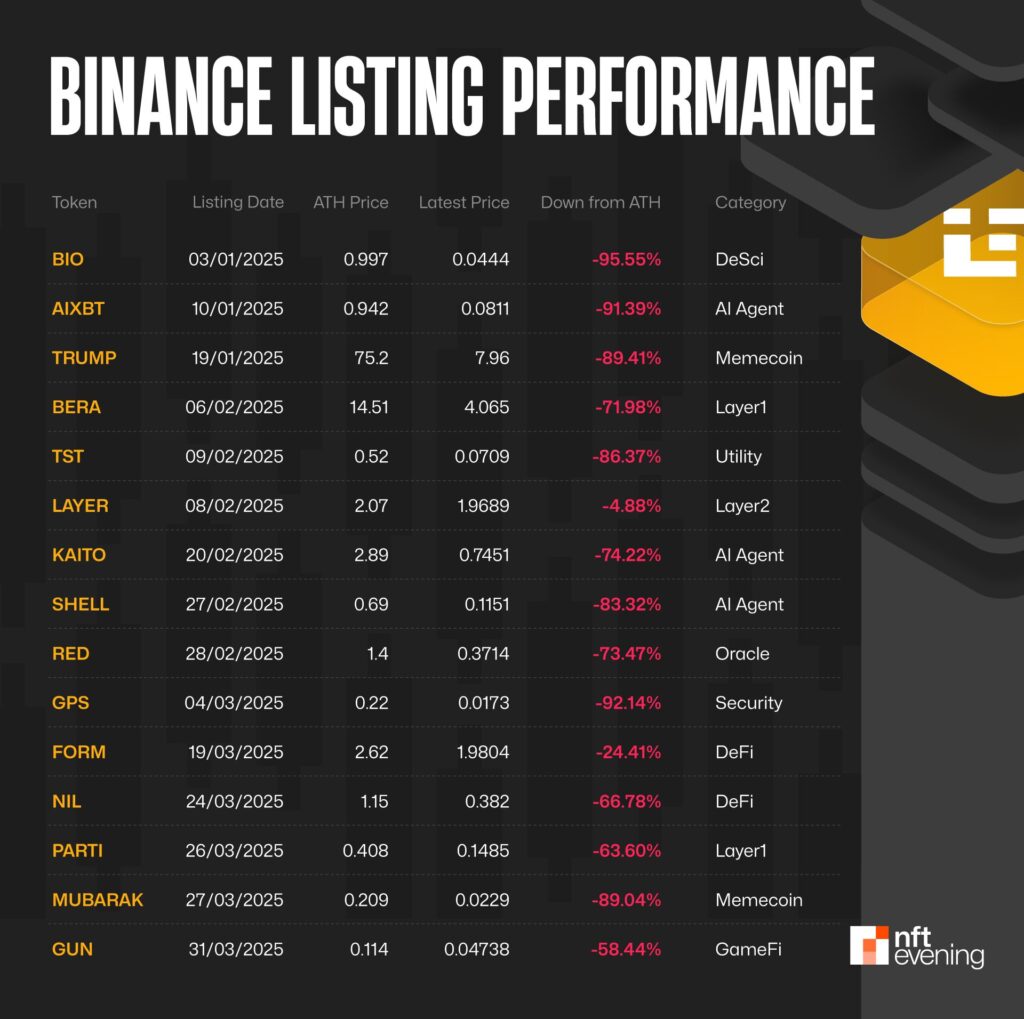

Recently, the tokens listed on Binance have continued to perform poorly, causing general disappointment in the cryptocurrency market. Only 2 of the 27 tokens listed in Q1 2025 showed a price increase, while the remaining 89% plummeted, and some lost 90% of their value.

This poor performance has caused widespread suspicion among investors and eroded trust in Binance as a high-quality project platform. Instead, many now see binary lists as predictable cycles of hype, pumps and dumps. This article explores the extent of this issue, highlights specific cases, and proposes reasons for the decline in confidence in Binance’s listing strategy.

Binance List: From Hype to Heartbreak!

The data depicts a grim picture. In Q1 2025, Binance listed 27 tokens, but only $layer (+86.73%) and $form records earnings. The rest, including high-profile tokens such as $TRUMP, $MUBARAK and $PARTI, suffered huge losses.

For example, Trump’s $thrip is hyped as a meme coin associated with political narratives, listing over 70% due to a massive sell-off. Similarly, $mubarak and $parti follow a familiar pattern: a short pump powered by pre-column hype, followed by a sharp dump of large holders or “whales” that clear their position.

$Trump’s Recent Performance – Source: binance

This consistent poor performance has caused investors to question Binance’s review process. Now, many suspect that the exchange prioritizes projects that are willing to pay for high listing fees for high fundamental projects. The perception that binance has become a “dumping place” for low-quality projects is attracting attention, and the community on X has even launched hashtags like #BoyCottBinance. Investors increasingly view binary lists as warning signs rather than recognition, which contrasts with their pre-exchange reputation.

Why does the Binance list crash?

A toxic mixture of greed, market dynamics and strategic mistakes has led to a catastrophic price drop in the tokens listed on Binance in 2025. From the sky-high listing fees to the meme coins obsession, that’s why the newly listed symbols are faster than ever.

High list cost: dry pre-flight items dry?

Binance’s listing process is not only a paid game, but also a resource repository that may weaken the project. Securing a place on the exchange requires millions of dollars in fees, forcing the project to pour almost all of its financial and operational muscle into the listing itself.

This comprehensive bet leaves thin projects that lack strong supporters or clear long-term strategies that are dangerously exposed. Tokens like $mubarak and $parti illustrate this, which went through huge hype during the stage of listing and spent a lot of resources to secure the position of binance. However, the collapse after they issued was due to weak fundamentals and a budget stretch that failed to sustain growth.

With no runways innovating or executing, these projects shaky, their price ($Mubarak) dropped 70% – investors burned and wondered whether Binance was a springboard for success or a dream of over-extending the cemetery.

Binance’s Liquidity Trap: The Perfect Dump Area

Binance, whose daily trading volumes usually exceed $20 billion, is the preferred destination for projects seeking cashback. This high liquidity makes it an ideal “final stop” for whales and insiders to unload large supply of tokens, triggering cruel pumping and lowering plans.

At $ Mubarak’s price: a hype pre-install, it soared until large holders dumped millions of tokens and it crashed over 70%. Similarly, a coordinated sell-off has fueled a 70% drop in Trump’s $70%, which usually hints at market makers like Wintermut. Binance’s liquidity once was a strength, has become the magnet for these predatory strategies, making retail investors collateral damage.

Source: TradingView

Other Causes of Catastrophic Recipes

In 2025, the broader crypto market is a cemetery of confidence that expands Binance’s listing dilemma. The fear and greed index has been in fear since January, reflecting the retreat of retail investors in global trade tensions, such as the U.S.-China tariff surge to 125%. Additionally, liquidity drought makes new tokens easy to prey on volatility.

Source: binance

Worse, Binance’s obsession with meme coins like $TRUMP and $Mubarak is scattered in huge juggling. The meme coin craze triggered by the end of 2024 emerged in the 2025 bear market, with investors eager to provide real-world utilities. Binance failed to adapt to the reputation of demanding Sizzle’s market harsh material.

Other factors include active sell-offs by market makers like Wintermute, as shown by the $ACT token dump, and changes in tokenology that erode investor confidence, such as increased supply of $OM and inflation adjustments. These issues, combined with events like FDUSD Stablecoin Depeg, have exacerbated distrust of Binance’s transparency and reliability.

in conclusion

Binance’s recent listings have seriously undermined market confidence. To restore trust, Binance must prioritize quality over quantity in its list and address concerns about transparency. Until then, investors may remain cautious, viewing binance as a launch pad for innovation, but rather a cautionary tale of hype and disappointment.