The industry has been recently stunning by the catastrophic collapse of the April 14 spell project.

Originally a promising reality asset (RWA) tokenization project quickly turned into a warning market manipulation, questionable practices and broken trust. This article delves into the $OM crash, its potential red flags, and its wider impact on the cryptocurrency space.

Spell dump – One candle eliminates $6 billion

About the spell

Mantra is a layer 1 blockchain focused on real-world assets (RWAS) in a security-first way, and the approach is built on the Cosmos SDK for use by institutions. Its $OM token was launched in 2020 and drives governance, points and transactions. Centralized exchanges such as Gate.io, Okx and Binance list $OM, enhancing liquidity through pairs such as OM/USDT. The token soared to an all-time high of $6.30 in early 2025, boosting 500 times from low market hype and FOMO, although later investigations linked its rise to speculative manipulation.

Historic collapse

On April 14, $OM Token experienced one of the most dramatic crashes in recent crypto history, with crashes in one of the day plummeting more than 90%. The token traded at about $6.30 a day ago, collapsed to $0.40, reducing its market value from nearly $6 billion to just $683 million. This sudden decline triggered a liquidation of more than $74.7 million, with some individual positions losing more than $1 million.

Source: CoinMarketCap

The crash was so serious that it removed the $OM holders’ years of gains, many of whom attracted more than 500 times the displacement from their all-time lows. Many investors suspect it was the carpet and manipulation of the Mantra team, which happened similarly in the Luna case.

Similar situations of Luna crash – Source: TradingView

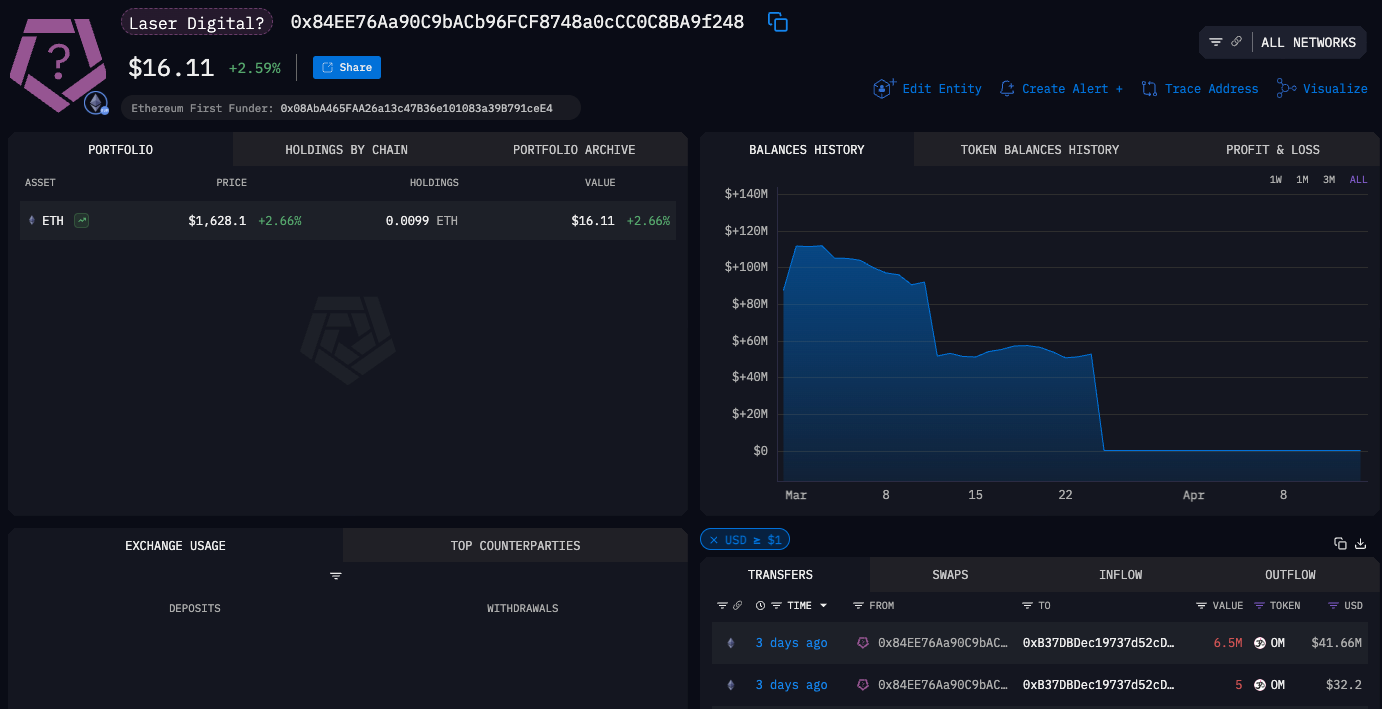

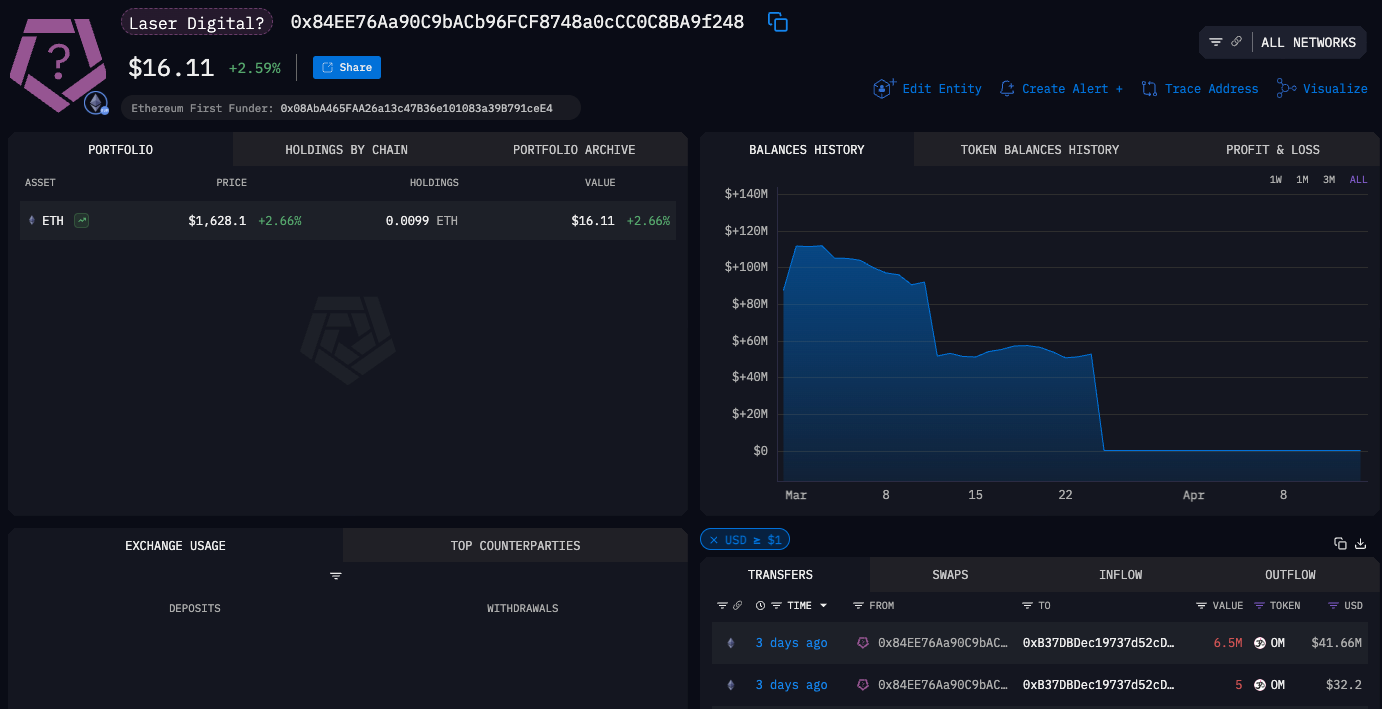

Additionally, the community found a significant link between the $OM token crash and the laser number, which made strategic investments with the laser number. Two of the 17 wallets associated with the incident were allegedly related to Laser Digital. However, the group quickly denied any involvement, refuting the claims of intervention in the matter.

Laser Digital’s 2-link wallet address – Source: Arkham Intelligence

Whispering shocking carpet pull program

Spell co-founder John Patrick Mullin immediately refuted any allegations of internal manipulation or carpet pull. He attributed the crash to “reckless closure initiated by centralized communication by OM account holders”, claiming that these actions were not sufficient warnings or margin calls. The Spell Team insists that their token allocation is still locked and verifiable chains and they are actively investigating the incident to reveal the real cause of the crash.

Sherpas, Omies and the broader crypto community,

First, the team and I are very grateful for the support we have received over the past few hours, and we think it proves the strong support of the spell in its investors and communities.

We’ve confirmed…

– JP Mullin (🕉, 🏘️) (@jp_mullin888) April 13, 2025

However, crypto investigator Zachxbt raised serious doubts about the official narrative. He pointed to two people allegedly involved in the spell incident: Denko Mancheski, the founder of Reef Finance, and a user named Fukugo Ryoshu. According to him, the men have been in contact with multiple political parties during the days of the crash, seeking large loans against their $OM holdings. This revelation has sparked speculation about coordinating market manipulation, especially given the history of Reef Finance’s own history of similar events, including a used car launched in October 2024 and a $80 million OTC deal with Alameda in 2021.

Read more: Spell catastrophic collapse: $5.5 billion disappears in the crash

The impact on the community and investors is devastating. Many users regretted the $15 million loss and declared the industry a “scam”. Others accused the spell and the obligation team of voluntary planning liquidity exit. The crash destroyed the financial portfolio and eroded trust in the RWA tokenization field, raising broader questions about market stability and the integrity of centralized transactions.

Red flag around spell project and $om token

While some might think the $OM crash is sudden, a careful examination of the spell project reveals that a series of warning signals has been established for some time. These warning signs paint disturbing pictures of projects that may be built on a shaky foundation.

The suspicious team and the spell project itself

First, market analysts found that the spell team controlled 90% of the token cycle supply. This extremely high concentration of ownership gives the team significant control over the price and liquidity of the token, making it very susceptible to manipulation. In the cryptocurrency space, this structure often draws attention as it enables insiders to coordinate pumps and dumps, which negatively affects retail investors.

The team behind Mantra Dao also has a controversial history. Reports have shown that some team members participated in fraudulent initial coin products (ICOs) during the cryptocurrency boom in 2017, while others were associated with running a casino, a detail that caught the community’s eyebrow. In addition, past Mantra Dao faced legal scrutiny for failing to provide transparent financial reports, further undermining trust in its operations.

Another focus is airdrops in spell processing plans. The project announced $50 million Airdrop as part of its Gendrop program, but before distribution, the team banned 50% of participants, claiming they were robots, but without a clear explanation. The team subsequently delayed the air conditioner, leaving many users frustrated and suspicious of the team’s intentions. The mantra exacerbates this, quietly changing its token learning without proper communication, a move that further fuels distrust.

A lot of overvalued and exaggerated $OM tokens

Rumors also circulated that the project sold large OTC transactions to investors at a price of 50% lower than market interest rates, a practice that allows insiders to uninstall tokens while artificially exaggerating the price of the tokens. This has something to do with another obvious problem: the disconnection between the valuation of $OM and its fundamentals.

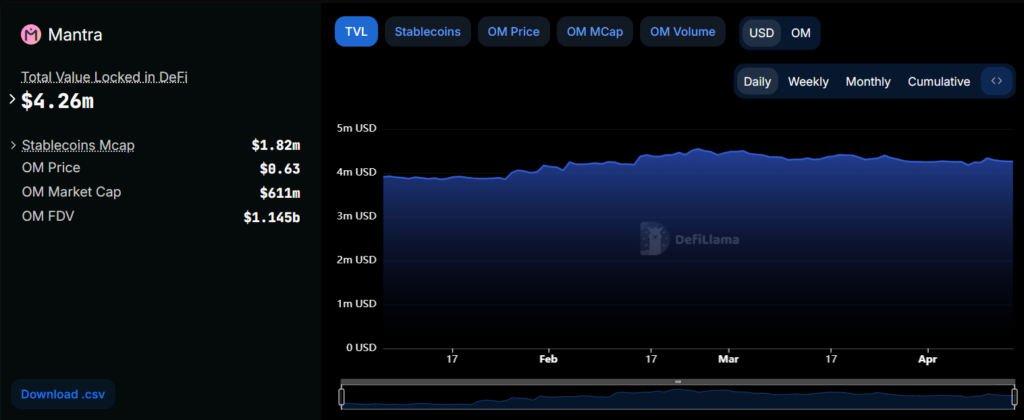

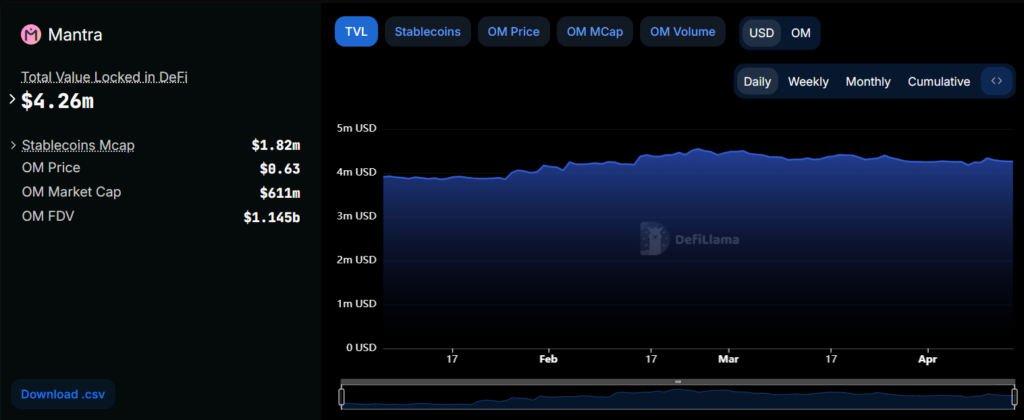

Prior to the crash, $OM’s valuation of Fully Dilution (FDV) was about $10 billion, but its total value lock-in (TVL) was only $4 million. This stark difference shows that market manipulation, FOMO and speculative narratives greatly exaggerate the token rather than real demand driving its value. It can easily collapse due to the lack of real buying pressure, and the price started to soar from its all-time low to more than 500 times.

Source: Defillama

When the crash ended, $OM’s valuation fell by nearly $6 billion, but TVL fell by just over $1 million. This observation raises a key question: Does the TVL in the Mantra ecosystem indeed reflect user activity, or is the project artificially inflated? The suspicious TVL slight decline compared to the huge valuation losses suggests that the team may have manipulated the ecosystem’s activities to falsely indicate adoption and value.

The involvement of characters like Denko Mancheski, who has a history of market manipulation of reef finance, only increases suspicion. The reef itself has experienced a similar pumping cycle, soaring 650% before crashing 64% after pushing out the used body in 2024. The similarities between reefs and spells are similar to those found by Zachxbt, suggesting that the rise and fall of $OM may have been orchestrated by experienced manipulators who leverage the trust and FOMO of retail investors.

in conclusion

The $OM token crash highlights the risks of cryptocurrencies, especially in hype projects that lack transparency. Despite the spell’s denial, like concentrated token ownership, dark team history and suspicious transactions, red flags have caused suspicion. The legend highlights the need for hard-working investors in a hype-driven market and calls for better regulation and assurance as the industry matures.