Over the past week, global markets have been attracted by uncertainty, reflected in the Bitcoin (BTC) roller coaster. After a sharp drop below $80,000 late last week, cryptocurrencies showed signs of recovery early this week. But BTC’s prices are far from stable due to macroeconomic pressures, geopolitical tensions and diverging investor sentiment at work.

Recent Bitcoin Price Updates: Weekend Crash and Tentative Recovery

The price of Bitcoin BTC The weekend hit a big hit, falling from high prices in the second half of Sunday, April 6 to $80,000 below $80,000. This decline marked the steep candle drop to $82,320 on April 2, followed by a further decline, from an earlier rally to $90,000.

Source: CoinMarketCap

Analysts attribute the sell-off to profit-making and broader market concerns tied to imminent U.S. tariff policies. But, by Monday, April 7, BTC BTC As chatterers stepped in, short-term sentiment shifted and began to rebound, returning to $85,000. Despite this increase, the market remains anxious, with traders focusing on $75,000-$80,000 and resistance close to $88,000-$90,000.

The question now is whether this recovery can be held, or whether there is more turbulence.

Read more: Crypto Volatiles Follow Trump’s Tariff Announcement.

Expected factors driving volatility

There are several interconnected factors that are expected to keep Bitcoin’s price down in the coming days:

Unresolved tariffs and trade war risks

The Trump administration’s tariff policy, which will come into effect on April 9, remains wildcard. Comprehensive and mutual tariffs were set in several countries and unexpectedly high tariff levels were imposed. This has led to turmoil between the state and investors, which are concerns about inflation and trade wars.

Negotiations with major economies such as China and the European Union (EU) are still ongoing, and as of April 8, 2025, there was no final tariff rate confirmation. China has confirmed retaliation measures and imposed a 34% tariff on U.S. goods, thus raising fears of a full-strength trade war.

Such an upgrade could strengthen the dollar, put down pressure on risky assets such as Bitcoin and could trigger a sell-off – BTC’s decline fell from $88,500 to $82,320 after the April 2 tariff announcement.

Conversely, if the U.S. and the EU reach an agreement to mitigate tariff and non-tariff barriers, it could facilitate a “risk-enabled” environment that would restore capital to the cryptocurrency market. The inherent uncertainty significantly leads to market volatility, allowing investors to foresee the potential economic consequences of the trade war or the possibility of a stable deal, putting Bitcoin’s price in a difficult situation until further clarity is obtained.

Feeding pressure and interest rate guessing

President Trump’s continued call for lowering interest rates and market pressure has put the Federal Reserve under scrutiny. In his March statement, Chairman Jerome Powell quietly dropped two key phrases, excluding rate hikes, suggesting that further tightening could be possible if consumer prices did not drop significantly.

After the closing meeting on the morning of April 7 (US time), market expectations are tending to slow down potential speeds in the near future. Lower interest rates could weaken the dollar and make borrowing cheaper, driving investment in speculative assets such as BTC. But if the Fed rejects Trump’s pressure and takes a hawkish stance to combat inflation caused by tariffs, Bitcoin could face downward pressure. Every word in the Fed’s upcoming minutes will be used for clues.

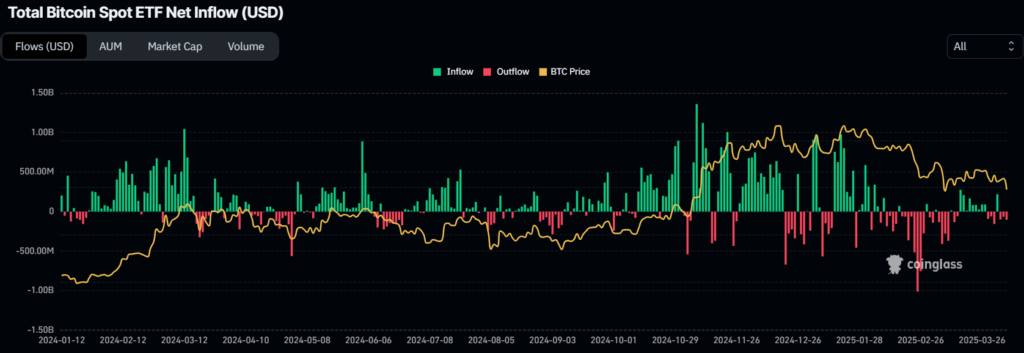

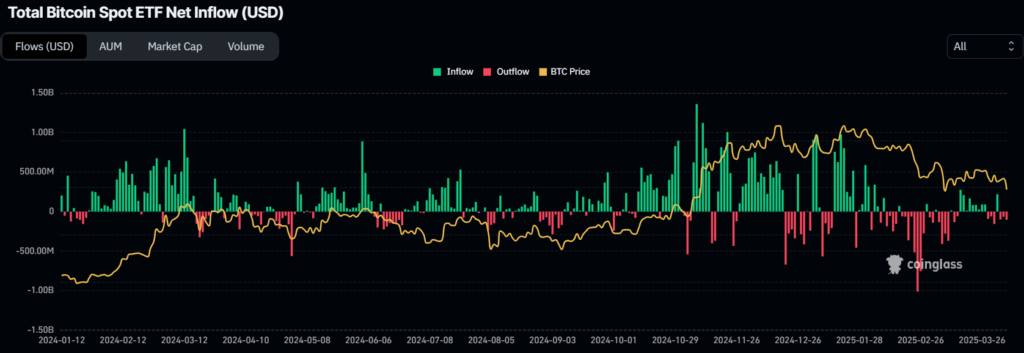

Bitcoin ETF outflow and institutional hesitation

Institutional investors have been retreating, with Bitcoin ETF outflows totaling $157.8 million on April 1 alone. In the case of macroeconomic uncertainty, this trend reflects the caution of the big players.

Source: Xiaodian

The reduced institutional purchasing power has left BTC vulnerable to sharp drops, as can be seen in last week’s collapse. However, some companies, such as Japan’s Metaplanet, added 160 BTC to their stake on April 1 and continued to accumulate, providing a balance. The conflict between outflow and selective purchases may exacerbate price volatility.

Microeconomic uncertainty

Macroeconomic factors will significantly affect the price of Bitcoin in the next week. The minutes of the FOMC meeting and the U.S. Shock Report will clarify labor market conditions this week. A shocking report that exceeded expectations showed strong job openings that could strengthen the dollar and put pressure on BTC downward as a risky asset.

Instead, weaker data may inspire expectations of currency easing, potentially weakening the dollar and increasing the price of Bitcoin. In addition, the index of low fear and greed reflects the market’s “fear” sentiment may expand volatility. As of April 8, 2025, these dynamics (combined with tariff uncertainty) may trigger sharp fluctuations, depending on how the data unfolds.

Crypto Investors’ Strategy

Given the current volatility, crypto investors need to stomp carefully. Here are four practical strategies to help you browse the current volatility:

Avoid overdriving and aggressive immersion

Since BTC’s price is prone to sudden changes, a large amount of leverage positions or overly enthusiastic “buy immersion” action can lead to huge losses. The unpredictability of the market (only a drop of $6,000 last week only) is showing caution. Scale the back lever and size position carefully until a clearer trend appears.

Monitor feeding signals closely

The next move by the Fed will be key. Hawkish signals (e.g., tips for rate hikes) may cause sell-offs, while voiceovers (e.g., confirmation of tax cuts) may inspire rally. Investors should track the Fed statement and prepare their export or entry plans accordingly. Setting a stop loss or paid level can help manage risks in these event-driven waves.

Stay liquid with stablecoins

Retaining a portion of your portfolio in Stablecoins like USDT or USDC (USDC) provides flexibility. If BTC lowers key support levels such as $75,000, liquid reserves allow you to buy without scrambling to buy. This approach can also prevent long-term downturns and provide space for your market adjustments.

Adopt USD Cost Average (DCA) strategy

In this environment, the timing of the market is risky. Instead, consider DCA – order a fixed amount of BTC regularly. This method will average your entry price over time, reducing the impact of volatility. For example, weekly purchases can expose exposure to sudden drops or peaks, which is ideal for long-term holders.

In recent days, the price of Bitcoin has experienced significant fluctuations, falling below $80,000 and then rebounding more than $85,000. However, the path forward remains uncertain, from unresolved tariffs, Fed policy shifts and wavering institutional flows. It’s a time for discipline for investors – avoid reckless bets, stay informed and balance risks with opportunities.