In the early hours of April 2 (American era), it marked a new escalation in the trade war as U.S. President Donald Trump announced full tariffs on all countries.

Trump announces high retaliatory tariffs in multiple countries

At a press conference on April 2, Trump signed an executive order to impose reciprocity tariffs on many countries around the world, aiming to restore what he calls the “fair trade balance.”

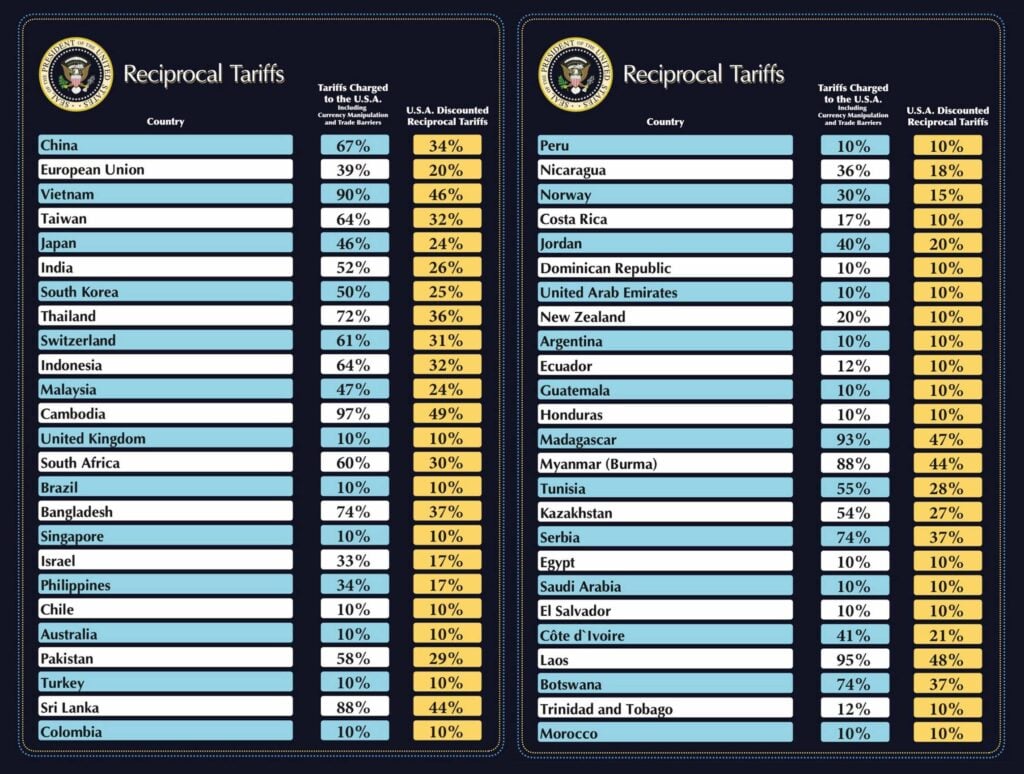

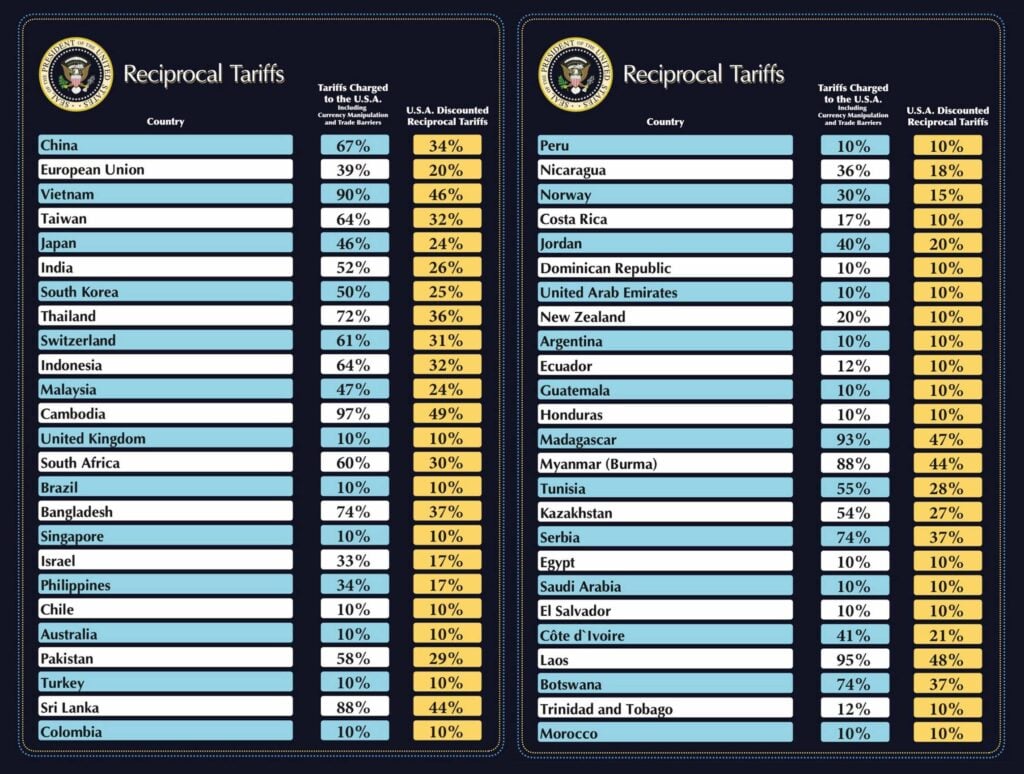

Tariffs are targeted at a wide range of commodities, and prices vary by country and product. The United States will impose a standard 10% import tariff on all goods entering the country and apply other retaliatory tariffs to certain specific cases. The standard tariff will come into effect on April 5.

What is even more worrying is the new rate of retaliation, described as “unprecedented” and very high. For example, China’s tariffs would be 34%, Cambodia’s 49%, Vietnam’s 46%, the EU’s 20%, Japan’s 24%, and India’s 26%. These retaliatory tariffs will come into effect from April 9.

Source: White House

Trump described these speeds as a starting point for “basic and humane”, emphasizing that he could adjust in the future based on the status of U.S. trade relations.

The economic impact of these tariffs is expected to be significant. In the United States, higher import costs may promote inflation and slow growth, which may lead to stagnation. Globally, supply chains could be disrupted, reducing trade volumes and exacerbating economic tensions. The Tax Foundation estimates that Trump’s tariffs could reduce U.S. GDP by 0.4% and cost 358,000 jobs before foreign retaliation. The WTO warns that such protectionism can further narrow global GDP and deepen uncertainty.

Critics argue that the U.S. approach is flawed – tariffs on trade deficits rather than actual trade barriers – global trade dynamics and potentially undermine international competitiveness.

Severe reaction from the country, the global trade war escalates

Analysts are deeply concerned that Trump’s actions will trigger a new global trade war, such as China or the European Union (EU). They may retaliate against tariffs that protect their domestic economy.

International responded quickly to Trump’s tariff announcement and criticized:

- China’s Ministry of Commerce announced that if the United States does not revoke these measures, it will take “resolute countermeasures” against the large-scale tariffs announced by President Trump.

- “If negotiations fail, we are ready to take further measures to deal with U.S. tariffs,” said European Commission President Ursula von der Leyen.

- Ireland: The Irish Foreign Minister deeply regrets Trump’s tariff decision.

- Brazil: President Lula Da Silva’s administration has announced plans to retaliate against U.S. tariffs, but is concerned about further escalation as the U.S. could raise tariffs from 10% to 28%.

Despite strong opposition, U.S. Treasury Secretary Scott Bessent urged countries not to retaliate, believing that tariffs represent upper limits aimed at stabilizing markets and reducing risks to trade tensions. However, such requests are unlikely to prevent major economies from taking defensive measures.

A heavy blow to traditional financial and crypto markets

After the news ended, gold prices soared to more than $3,150 per ounce as investors flocked to safe haven assets to protect their wealth, but generated by rising uncertainty.

However, the traditional financial markets and cryptocurrency sectors have not performed well. Kobeissi’s letter reported that the S&P 500 lost more than $2 trillion in market cap, with shares of major tech giants such as Apple, Microsoft, NVIDIA, Amazon, Amazon, Alphabet, Meta and Tesla down 3% to 7% in hourly trading.

April 2, 2025

•President Trump announces a brand new tariff plan.

•The United States will impose a 10% tariff on certain countries on all import taxes and higher interest rates.

•U.S. stock futures are rolling. https://t.co/aisjr4zhyz pic.twitter.com/sfiacrnn3e

– Beer Market (@Brewmarkets) April 2, 2025

The cryptocurrency market has also taken a major blow. Initially, news of the 10% tariff led to a slight increase in Bitcoin (BTC). However, after the full news, the price dropped sharply from $88,500 to $83,000 below $83,000. Meanwhile, Ethereum (ETH) fell by more than 6%, from $1,934 to $1,797, according to Coingecko. Cryptocurrency market capitalization fell 5.3% to $2.7 trillion. The fear and greed index reaches 25, indicating “extreme fear”.

Source: Coingecko

Learn more: BTC, ETH and XRP abandoned after Trump’s speech

Optimistic long-term view

However, then the price of Bitcoin partially recovered. David Hernandez (21shares) noted that this sharp volatility is understandable, but clarity can bring long-term benefits. Despite higher tariffs than expected, the market remains stable and tends to be certain.

Bitcoin (BTC) rose slightly when investors sought asylum in leading cryptocurrencies, but most altcoins were stalled or refused. The Bitcoin Advantage Index (BTC.D) remains high, indicating that capital is very concentrated on BTC, leaving altcoins in a lateral movement or decline state.

Source: TradingView

According to Coinglass, Bitcoin ETF inflows increased, indicating that confidence in BTC is a hedge against economic uncertainty. However, other crypto ETFs, such as ETH ETFs, show no significant signs of optimism. ETH ETF inflows remain flat, and many altcoins-centric funds are experiencing outflows, reflecting investors’ confidence in the wider crypto market. As investors prioritize Bitcoin over smaller, more volatile assets, this difference emphasizes the current risk aversion sentiment in the market.

Source: Xiaodian

The stagnation in the broader cryptocurrency market reflects growing concerns that Trump’s tariffs could exacerbate inflation, which could prompt the Fed to stop lowering interest rates, a move that would hurt risky assets such as cryptocurrencies. Both traditional and cryptocurrency markets have achieved further volatility in the coming weeks as global trade tensions escalate.