As one of the world’s leading cryptocurrency exchanges, Binance has evolved into a huge ecosystem supported by BNB (Binance Coin). This article discusses BNANCE, BNB and predicts future trends in BNB prices.

What are BNB coins?

About binance

Binance is one of the world’s largest and most influential cryptocurrency exchanges, offering a comprehensive suite of financial services including spot trading, futures, points and Defi Solutions. Founded by Changpeng Zhao (CZ) in 2017, Binance has rapidly developed into a global power, providing users with a safe and effective digital asset trading platform.

In addition to its exchange services, Binance has expanded to a mature blockchain ecosystem, facilitating innovation through the BNB chain network that supports thousands of decentralized applications (DAPPs), smart contracts and DEFI protocols.

BNB: Local local symbols

Binance Coins BNB It is a local symbol of the Binance ecosystem and plays a central role in its operations. BNB was originally launched on Ethereum with ERC-20 tokens and later moved to BNANCE’s proprietary blockchain network BNB Chain.

BNB use cases

On a second-hand exchange

- Transaction fee discount: Users who pay with BNB receive approximately 25% off on-site and margin transaction fees.

- The basic currency of the transaction pair: BNB is the base currency of binary trading pairs.

- Binance Launchpad: Holding BNB allows users to invest in new projects and specifically purchase BNB’s tokens.

- Add rewards: Users can make use of BNB to earn advantages while contributing to network security.

- Loan collateral: BNB can be used as collateral for loan platforms such as Venus.

About Second-hand Chain and Binance Smart Chain (BSC)

- BNB is used as the local gasoline fee for all chain transactions.

- BNB also acts as a governance token, enabling holders to participate in on-chain decision making.

Payment and Real-life Application

- BNB is accepted as payment via Binance Pay and Binance Visa cards.

- Many external merchants and service providers support BNB as a payment option.

BNB in the Defi ecosystem

- BNB plays a crucial role in BSC’s Defi ecosystem, powering a variety of applications:

- Pancakeswap (AMM DEX): BNB is the main asset in the liquidity pool.

- Venus Agreement: BNB is collateral for borrowing and loans.

- Produce farming: BNB is widely used in the yield aggregation platform on BSC.

- Binance NFT Market: BNB is the main currency for trading.

What is a BNB chain?

- The BNB chain consists of two parallel blockchains:

- BNB beacon chain: handles governance and static.

- BNB Smart Chain (BSC): supports smart contracts and is fully compatible with Ethereum.

- BNB Chain stands out:

- Proof of the Fixed Permissions (POSA) consensus mechanism generates blocks every 3 seconds.

- There are only 21 validators that ensure high efficiency, but less decentralization than Ethereum.

- Low transaction fees and high throughput (~100 tps compared to Ethereum’s ~20 tps).

- Full EVM compatibility makes Ethereum-based DAPP easy to migrate.

BNB chain ecosystem

Key products and services

- defi: Pancakeswap (DEX), Venus (Loan), Alpaca Financing, Butter Financing (Production Summary).

- NFT and Gamefi: More than 300 blockchain game projects on the BNB chain account for 50% of the top decentralized games.

- Web3 Application: DYDX (BSC version), Stablecoin Busd, Daos and governance platforms.

Notable statistics

- In 2021, BSC processed an average of 7 million transactions per day (about 350,000 earlier in the year).

- All-time high: 14.7 million transactions in a day (November 17, 2021) – 10 times Ethereum transactions.

- The accumulated chain transactions of 1 billion+ will be only one year after their release.

- Active wallets peaked at a peak of more than 2 million users.

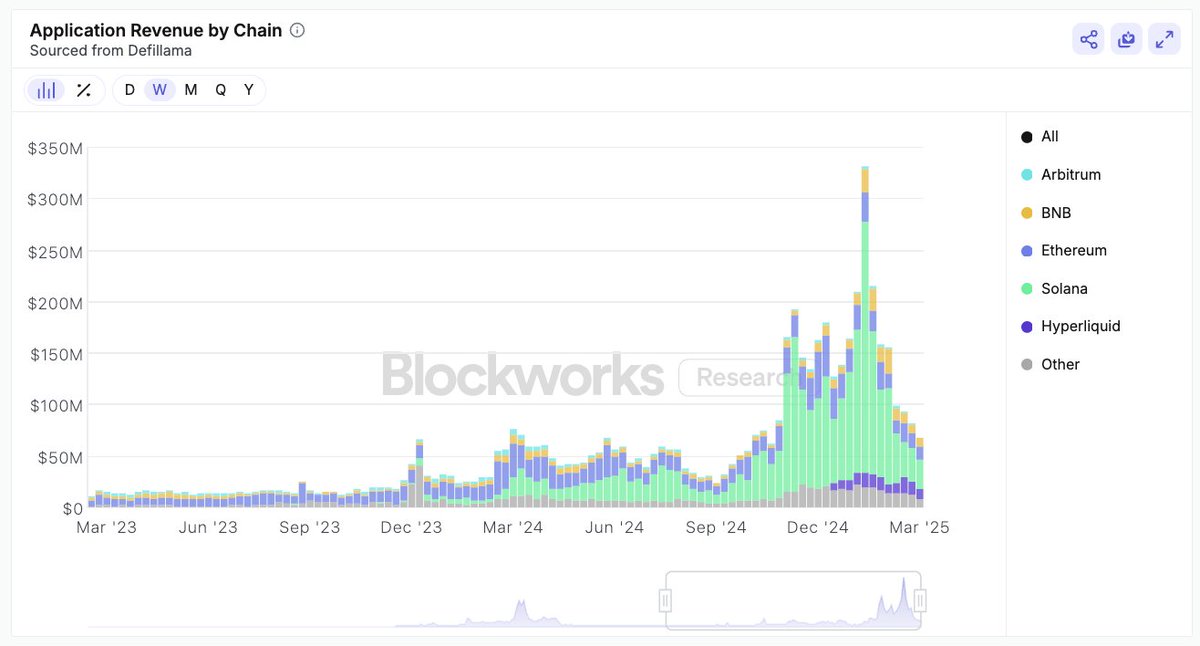

Source: Defillama

Binance CEFI and DEFI integration

- Users can seamlessly use BNB across binary services, including transactions, points, loans, agriculture and NFT purchases.

- Binance is actively integrating realistic payment solutions, working with platforms such as Travala and Classicbritishcars to enable BNB to be used for travel booking and luxury purchases.

Source: BSCDAILE

BNB Token Learning

- stock: BNB

- Blockchain: Binance chain and binance smart chain

- Consensus mechanism: Tendermint

- Total supply: 145,887,575 BNB

- Maximum Supply: 200,000,000 BNB

- Recycle supply: 145,887,575 BNB

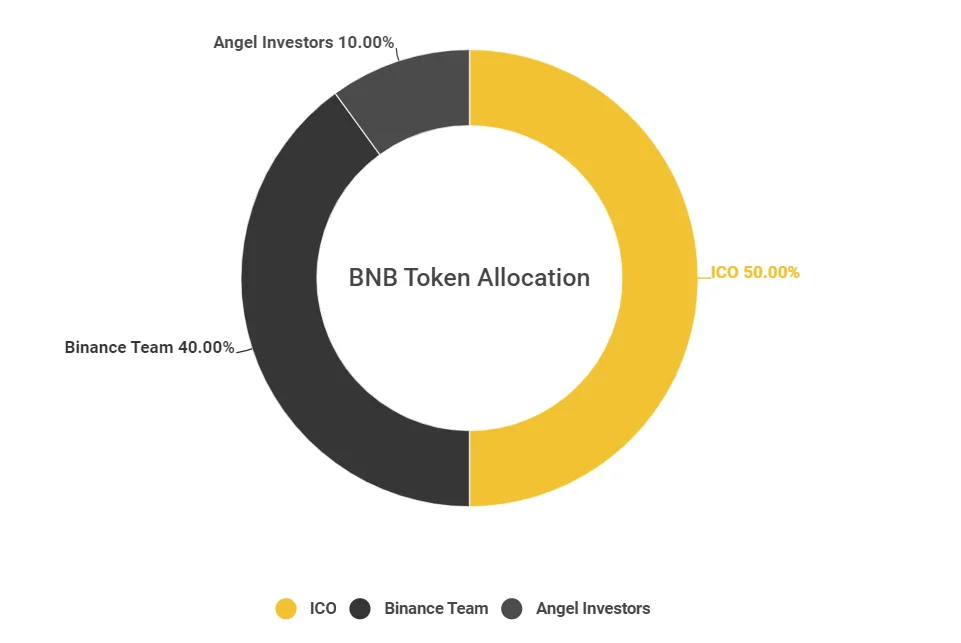

Token allocation

Initially, the total supply of BNB was 200,000,000, with the distribution as follows:

- ICO: 50% – 100,000,000 BNB

- Binance Team: 40% – 80,000,000 BNB

- Angel Investors: 10% – 20,000,000 BNB

Source: Binance Blog

The key feature of BNB tokenology is its regularity Combustion mechanismDesigned to reduce circular supply and enhance token value over time. Binance has promised to burn gradually 100 million BNB (50% of total supply) until Recycling supply has been reduced to 100 million BNB.

BNB release schedule

Binance releases BNB tokens under the following plans:

- ICO: There is no lock-up period. Five days after the ICO ended, investors received the BNB.

- Angel Investors: There is no lock-up period. After the ICO is completed, investors receive all allocations.

- Binance Team: Binance team allocations are locked and released gradually Five years by 20% per year (16 million BNB per year).

BNB price forecast

Basic analysis of BNB

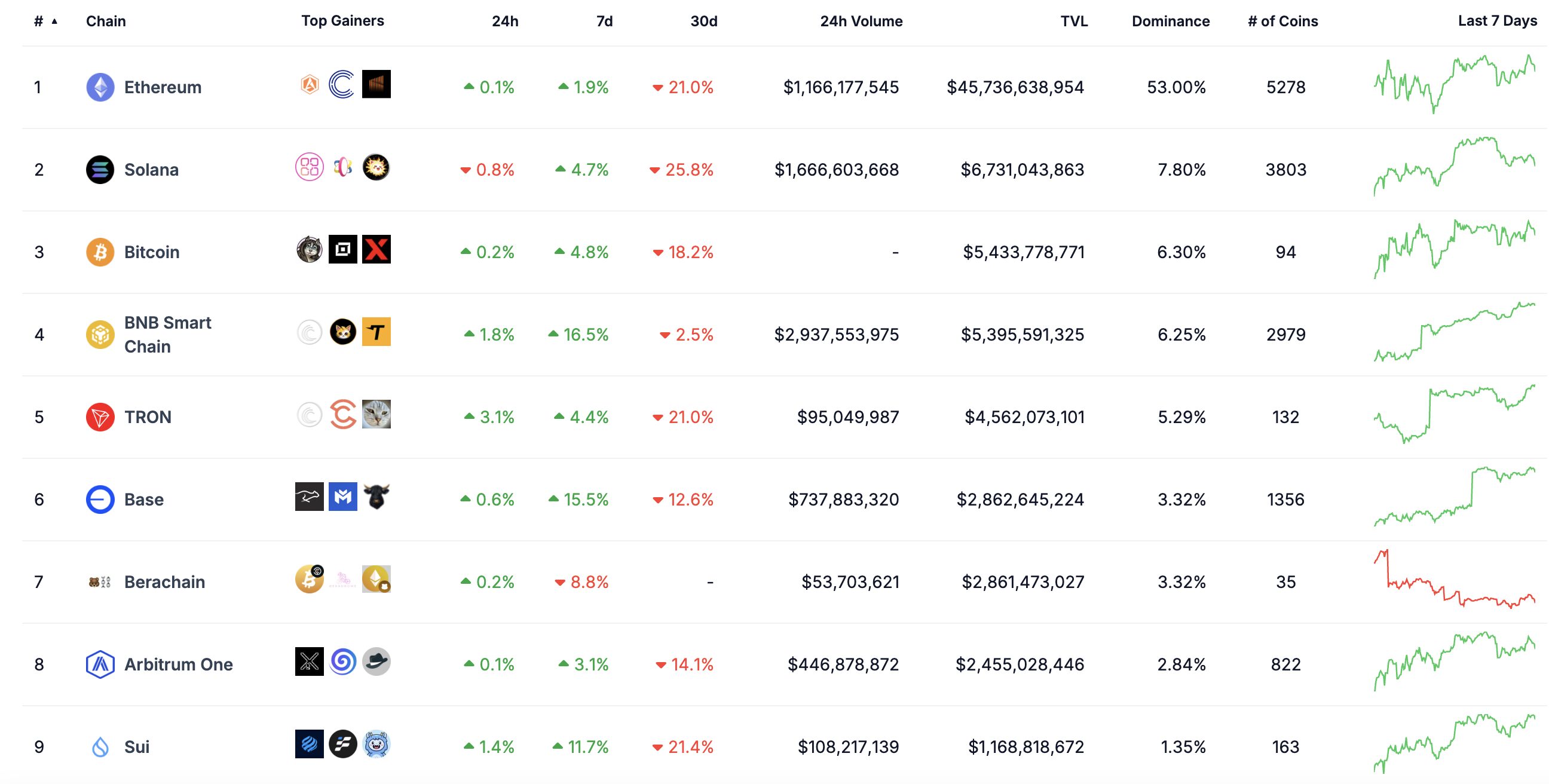

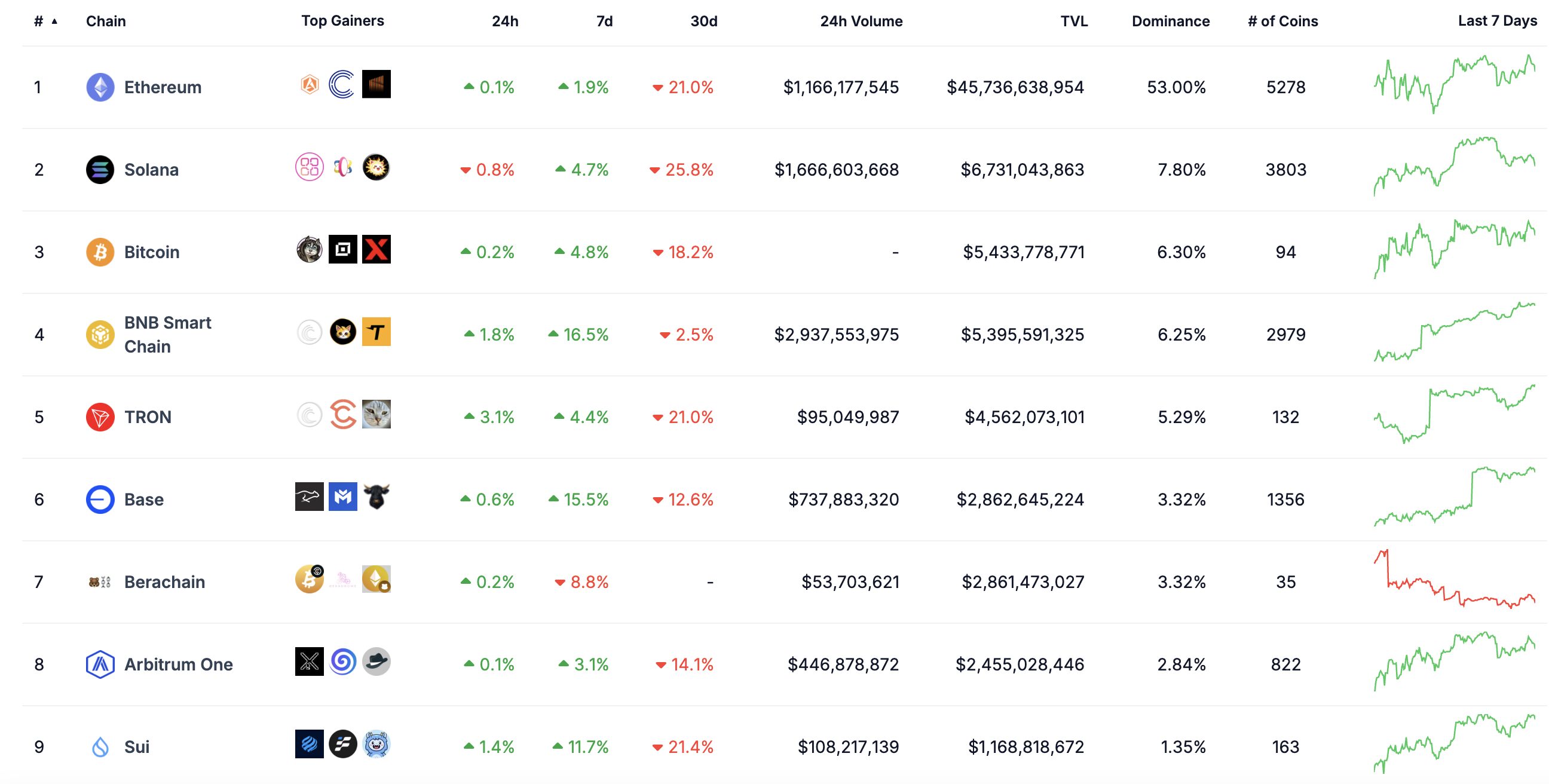

Weekly updates (App revenue, market share, weekly changes) Start with several famous blockchains:

- Solana: $279 million, 50%, -16%

- Ethereum: $12.9 million, 23%, -12%

- BNB: $8.4 million, 15%, + 2%

- Base: $4.4 million, 8%, -23%

Source: Dan Smith’s post on X

The BNB chain currently has a TVL of $5.346 billion, ranking fourth in the world. It exceeds:

- Base ($2.87B, 6th)

- Arbitrators ($2.46B, No. 8)

- SUI ($1.17B, No. 9)

Source: Coingecko

24-hour DEX volume on the BNB chain

The dominance of BNB chains in DEX volume highlights its role as a leading decentralized trading center, driving BNB’s demand in transaction fees.

- According to Coingecko, the BNB chain’s current TVL is $5.339 billion, ranking fourth in the world. It exceeds:

- Base ($3.042B, 6th)

- Arbitrators ($2.509B, No. 8)

- SUI ($1.152B, No. 9)

Source: Defillama

- 24-hour DEX volume on the BNB chain:

- $2.586 billion (highest of all blockchains)

- compared to:

- Ethereum: $1.348 billion

- Basics: $426.2 million

- Arbitrator: $385.81 million

- ON: $159.94 million

Source: Defillama

The dominance of BNB chains in DEX volume highlights its role as a leading decentralized trading center, driving BNB’s demand in transaction fees.

Memecoin and low hat token activity

- Memecoin activity on the BNB chain is booming, with tokens similar to:

- $tut is mentioned in the video soaring 5 times.

The 7-minute video a year ago should now be a tip for AI robots. I think there are already several on the BNB chain. Let’s see some videos? https://t.co/yohqmendi

– cz🔶bnb (@cz_binance) March 17, 2025

- Other active tokens: $cheems, $tst, $bmt, $shell.

- $tut is mentioned in the video soaring 5 times.

- Seen on Solana and Sui, Memecoins has historically driven a wave of trade.

- Their presence in the BNB chain brings liquidity and new users and indirectly supports BNB.

- The pump drop. FUN created opportunities for four, the greatest community traction and exacerbated the further push of BNB chain activity.

Binance’s actions and the impact of CZ

- Binance lists the tokens for Binance Alpha and has TGE as $BMT and $Shell to attract investors and projects into the ecosystem.

- CZ pass:

- Test transactions with $TST.

- Promote $ Mubarak on Binance Square.

These actions have driven transaction volume, increased market attention and enhanced the BNB chain’s ecosystem, thus supporting BNB price growth.

Network upgrade and growth potential

- The upcoming hard fork will improve network efficiency:

- Pascal (March 2025), Lorentz (April 2025), Maxwell.

- Benefits include reduced block time, higher TP and lower fees. (Source: BNB Chain X Post)

These upgrades will attract more developers and users, enhance the demand for BNB, and enhance competitiveness for Ethereum and Solana.

Recent price performance and market comparison

- BNB 24-hour performance:

- +Add 1.84%

- 38.70% increase in transaction volume

- Comparison with major assets:

- Bitcoin: -0.12% (Price: ~$83,696)

- Ethereum: +1.73% (Price: ~$1,925)

- 30-day performance:

- BNB: -8%, but still shows relative strength compared to Bitcoin and Ethereum, reflecting investor confidence.

Despite short-term volatility, BNB remains the first choice asset and maintains flexibility in the crypto market.

Comparison table of key indicators

Here is a comparison table of key indicators between BNB chains and other blockchains:

An overview of BNB charts

Recent price trend analysis:

Coingecko is currently ranked BNB 5 by market capitalization. As of March 18, 2025, BNB is trading approximately $629.95the market value around $91,816,295,746 And 24 hours of transaction volume $1,769,078,204. This price reflects healthy liquidity and trader interest levels.

Historically, BNB’s price fluctuates greatly:

- High history: $788.84, indicating its peak performance.

- Lowest in history: $0.03982, marking its starting point.

- Current location: Trading volume is 20.40%, below its all-time low, indicating a strong recovery in its early stages, although it has not yet recovered its previous peak.

The chart reflects a coin that has experienced both a sharp sequel and corrected, with price movements closely related to the success of the two-strong ecosystem and the broader cryptocurrency market trends.

Technical Analysis: BNB Price Action

Source: TradingView

Source: TradingView

- BNB prices are currently consolidating WYCKOFF’s accumulation range, which marks a potential breakthrough opportunity.

- The price for short-term entry is $618.xx, but Nftevening does not recommend trading at this level due to potential volatility.

- The preferred interim admission fee is $500 – $501.9, providing a better risk-reward ratio.

- Key price levels to be monitored:

in conclusion

BNB continues to consolidate its position as a leading asset in the crypto ecosystem, supported by strong market fundamentals and technical resilience. The chain’s dominance in DEX volume, increasing TVL and expanding ecosystems provides a solid foundation for long-term growth. In addition, Binance’s ongoing development work, including network upgrades and new project lists, further strengthens its adoption.

From a technical point of view, BNB’s current merger in the Wyckoff accumulation model brings both short-term and medium-term trading opportunities.