SUI quickly transformed the blockchain landscape with its high-speed transactions and expanded Defi ecosystem. From record TVL to major partnerships, discover how Sui strengthens its position as a leading Layer 1 network in just a few months.

What is Sui?

SUI is an advanced layer 1 blockchain designed to address limitations of existing platforms such as slow transaction speeds, high costs and poor scalability. The maximum processing power of a base transaction (e.g. 100,000 TP) for P2P (e.g. P2P) and 100,000 TP (e.g. Defi) (e.g. Defi) (e.g. Defi) can reach up to 297,000 transactions (TPS), SUI surpasses many other platforms. Its average latency of 400ms is the lowest among all blockchains at present.

Strategic partnership with World Free Finance (WLFI)

Historical trends show that cryptocurrencies associated with famous figures such as Elon Musk and Donald Trump often experience a huge surge. For example, after Musk’s approval, Dogecoin’s price rose significantly, and Trump-related tokens also benefited from his influence. This pattern suggests that SUI’s recent partnership with the Trump-inspired DEFI protocol and World Free Finance (WLFI) may be crucial for SUI’s long-term growth.

Despite the current market decline, being consistent with Trump’s brand may be favorable to position, which could bring considerable benefits in the future.

Market reaction and impact on SUI price

Sui Token after the partnership announcement Sui Prices soared 15% in 24 hours to $2.86 with a market cap of $8.9 billion, highlighting the positive impact of the collaboration. As of March 13, 2025, Sui’s price fluctuated around US$2.25, with a market value of approximately US$7.2 billion and a trading volume of US$900.25 million. SUI is currently ranked 21st on CoinMarketCap, with a total supply of 10 billion tokens and a circular supply of approximately 3.17 billion tokens.

Ecosystem Growth

From December 2024 to March 13, 2025, Sui’s ecosystem has experienced significant growth, especially in Defi and infrastructure projects.

Total Value Lock (TVL) Growth

Based on the trends in Q4 2024, research shows that TVL may have exceeded $2 billion in March 2025, driven by contributions from new projects such as Defi protocols such as Deepbook and Walrus. A report published by Changelly (SUI Price forecast) on March 12, 2025 shows that TVL can continue to increase, although no specific numbers are available in March.

As of March 2024, SUI’s TVL reached a peak of $750 million, and in terms of TVL, it ranks among the top ten blockchains.

Trading volume

- According to Blockchain News, total cumulative transaction volume reached $44.3 billion by the fourth quarter, marking a 444.79% increase in $4.5 billion at the end of the third quarter of 2024.

- SUI’s 14-day moving average trading volume and spot trading reached US$166 million and US$125 million, respectively.

- Nearly 200 DAPPs are active in the ecosystem, including the CETUS protocol, consequences and FEFI protocols such as DeepBook. By mid-December 2024, Deepbook recorded only nearly $1 billion in transaction volume, according to the SUI Foundation blog.

- On-chain activity is booming, with daily trading blocks ranging from 3.32 million to 4.4 million, while daily trading rose from 9 million to 11 million.

- User adoption soared – Daily active accounts tripled from 424,000 to 1.2 million, a strong signal of growing demand and expanding ecosystems.

Famous projects in the SUI ecosystem

- Walrus Agreement: A distributed data network that enables secure and cost-effective data storage and distribution.

Source: Walrus

- SUI Name Service (SUINS): The decentralized naming service for blockchain addresses in readable names is simplified by the “@” prefix.

- Deep Book: The Central Restricted Order (CLOB) solution provides liquidity for Defi exchanges for SUI.

- CETUS protocol: Provides limited orders, generating liquidity agreements that generate agricultural, liquidity pools and treasury management tools.

- Suilend: Launched in March 2024, the lending platform achieved over $450 million in TVL in eight months, providing cross-chain swaps and bridges.

- NAVI protocol: The DEFI protocol combines DEX polymerization, liquid accumulation and loans with TVL of $714 million and 800,000 users.

Source: Navi

- Consequences Finance: A Defi aggregation platform that supports points and liquidity mining.

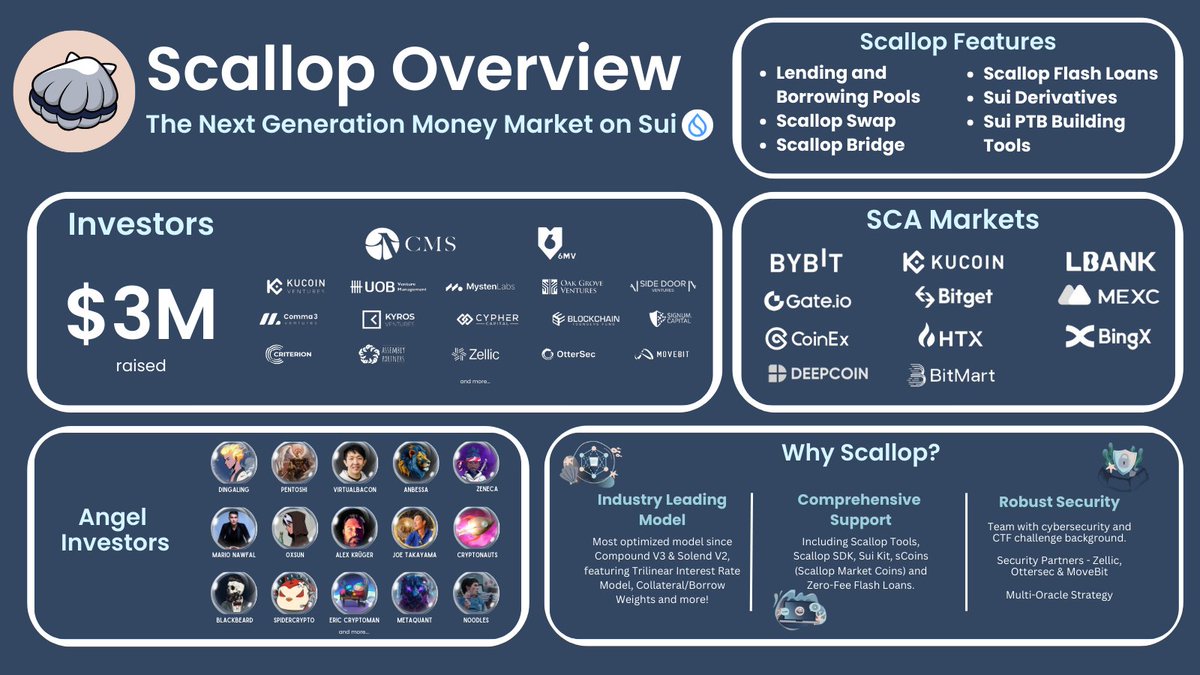

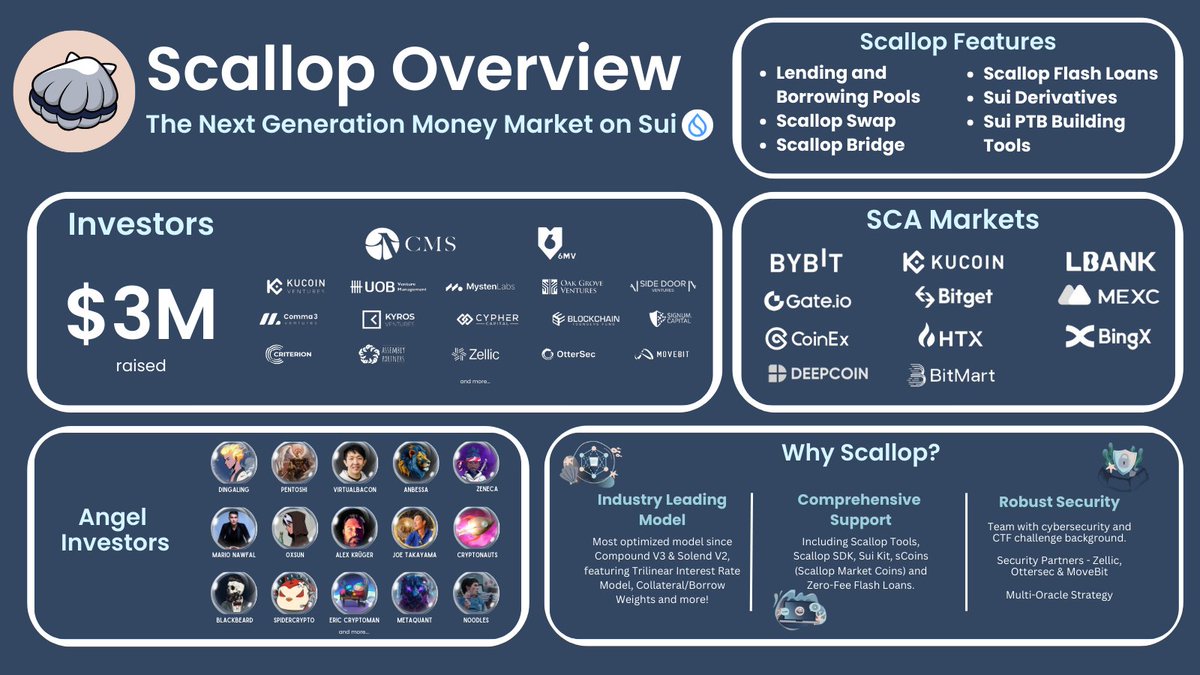

- scallop: A lending platform that meets a wide range of users, supports swaps and cross-chain bridges.

Source: Scallops

- Turbos Finance: A decentralized cryptocurrency market that provides exchange and liquidity services.

- TradePort: NFT marketplace, easy to discover, buy and advanced NFT creation tools.

Stablecoin Growth

SUI’s Stablecoin usage rose from $540,000 per year to $4.9 million, with much of the growth occurring in the fourth quarter of 2024 and early 2025. According to a report on March 11, 2025, On Xwhich reflects the thriving bias sector on SUI.

Other strategic partnerships

In addition to WLFI, SUI has established several strategic partnerships:

- A Champions Partnership (September 2024): Sui becomes a champion’s official blockchain partner and partnered with Animoca Brands to integrate into the Web3 mobile game One Fight Arena.

- Oracle Red Bull Racing Partnership (June 2023): Emphasizes the potential of blockchain in community engagement and connectivity.

Local USDC integration for SUI

Another milestone is the integration of local USDC on the SUI through a partnership with Circle in October 2024. This enhanced liquidity and cross-chain interoperability with networks such as Ethereum and Solana. Defi TVL on SUI exceeded $1 billion in October 2024, and exceeded $200 million from the beginning of the year, indicating strong adoption by developers and users.

Source: Defillama

Excellent technology and extended ecosystem

SUI parallel transaction processing enables horizontal scalability without sacrificing performance, which has a major advantage over other layer 1 blockchains such as Ethereum. The Defi ecosystem on SUI is also thriving, with major projects including:

- NAVI Protocol: The leading Defi lending platform on SUI.

- Scallops: Financial agreements that provide liquidity solutions.

- CETUS protocol: Outstanding decentralized exchange (DEX).

These factors contribute to a diverse and promising ecosystem that position SUI as a strong competitor in the major blockchain networks.

Risk Assessment and Challenges

Although there is no major controversy, some criticism of WLFI may indirectly affect SUI’s reputation, especially if the partnership is seen as a “paid” strategy. However, there is no specific evidence of wrongdoing. The project continues to be highly praised for its parallel transaction processing and horizontal scalability.

In addition, the cryptocurrency market remains volatile and Sui’s prices may be affected by macroeconomic factors such as regulatory policies or overall market trends.

in conclusion

Based on current developments, SUI has huge growth potential. Partnerships with WLFI not only enhance accessibility, but also open up opportunities for new product development. Milestones such as USDC integration and TVL growth have further consolidated SUI’s position. Despite some criticism of WLFI, there is no major controversy that directly affects SUI. The project remains an attractive option in the blockchain and Defi space.

Overall, SUI maintains a strong position in the market, with its promising growth prospects driven by a diverse ecosystem and strategic partnerships.