By July, Vice President, Toys, Industry Consultant, Vice President

Toys in the United States were $28.3 billion in 2024, which remained flat (-0.3%) in 2023. The slowdown in the U.S. dollar and unit has slowed significantly compared to the sharp decline in 2023 as the industry shifts from correction status over the past year to greater consistency.

From a five-year compound annual growth rate, the toy industry’s dollar grew by 5% year by year, driven by a 4% increase in average selling price (ASP) while the average annual average year for units sold increased by 1%. The toy industry is 26% bigger than in 2019, equivalent to nearly $6 billion in sales.

Compared to the roller coaster of the previous three years, the toy industry has remained stable throughout 2024, so we landed with a steady performance. There are some nuances along the way, such as the calendar shift in the fourth quarter (Q4), but consumers bought nearly the same toys for the same price as last year. This narrative is amazing.

A year of review

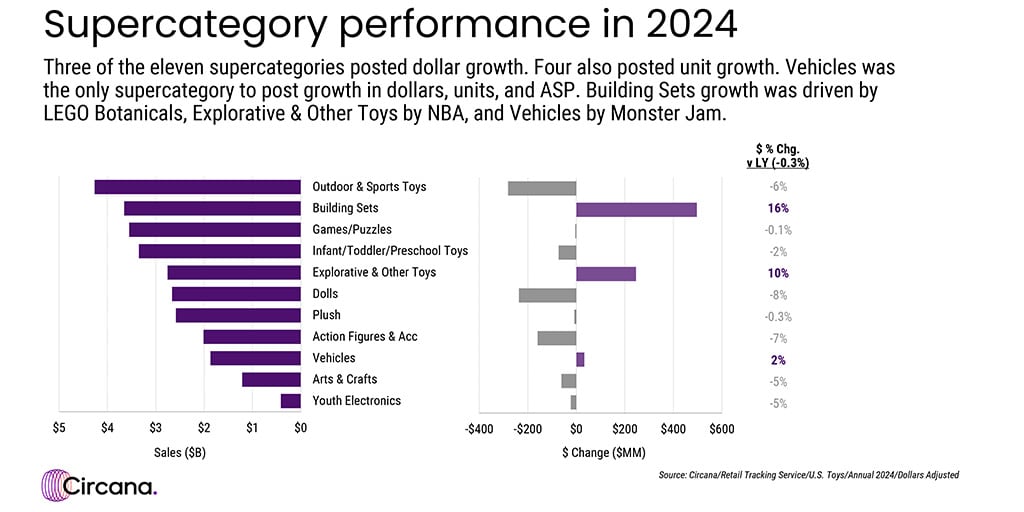

Looking at the product categories, 3 of the 11 super categories tracked by Circana released U.S. dollar growth in 2024.

Construction suits are the fastest growing super category, with USD and unit sales up 16% and the most significant USD earnings approaching $500 million. It popped up second in 2024 from the No. 4 super category in 2023, thanks to strong growth in the building set. Lego Botany, Lego Creativity, Lego Icons and Lego Creator 3 inches 1 account for the growth of this category. The Lego Group’s bouquet of rose plants (pictured) was the best-selling building sales item last year.

Exploratory and other toys saw year-on-year sales increase by 10%, contributing $246 million in revenue. The growth in this category is powered by the NBA and NFL trading cards as well as the MGA’s Miniverse, Donruss, MLB and Little Tikes. The best-selling item in 2024 is MGA’s Miniverse Make Mini Food Diner Minis category.

Another super category of U.S. dollar growth in 2024 is vehicles, up 2%. Monster Jam, Car Movies, Godzilla X kong, and hexadecimal robots are the main leaders. The best-selling product in 2024 is Mattel’s hot wheel singles 1:64 category.

In the super category that suffered the highest dollar losses of the year, sales of outdoor and sports toys fell by NERF, Kidkraft and Hover-1, or 6%. Zuru’s X-Shot, Bluey products and Kidkraft’s Cedar Summit performed well. The best-selling item among outdoor and sports toys is Zuru’s 3-piece packaging.

The dolls fell 8%, mainly due to lol while Barbie and Disney Princess fell year-on-year. Growth properties include Hello Kitty & Friends, 50, last year, Basic Fun! Relaunched Littlest Pet Shop and Disney Princess Moana. The best-selling doll item of 2024 is still a perennial classic, ranking number one on the list every year: Mattel’s Barbie Dream House.

Action characters and accessories fell by 7%, mainly powered by Star Wars, Marvel Universe, Super Mario Bros. and Funko Pop! number. Godzilla X Kong, Sonic the Hedgehog and Mrbeast released the most significant dollar earnings. The best-selling action characters and accessories project is Godzilla X Kong: The 6-inch character toy for the new empire.

According to dollar sales, the top 10 toy properties this year include Pokémon, Barbie Dolls, Squishmallows, Marvel Universe, Hot Wheels, Star Wars, Fisher-Price, Lego Botanicals, Lego Star Wars and the NFL. From the year, LEGO and sport are common themes. We’re also starting to see positive impacts at the box office, with Sonic the Hedgehog and Lilo & Stitch setting up growth lists.

Changeable catalyst

Circana’s receipt-based checkout data reveals interesting findings about recipient insights and reasons for buying toys. In purchasing occasions, “no special occasions” is still the primary reason for buying toys in 2024. The fastest growing occasions inspiring buying are achievements/rewards and Easter. Christmas and Hanukkah holidays decline in 2024 and 2023.

The fourth quarter was the softest quarter of Toys last year (seasonal adjustments to Easter for Q1 and Q2), which was expected due to shorter holidays, while shopping between Thanksgiving and Christmas fewer weekends. Toys are indeed the same as average when they are indeed the same as other discretionary categories, but this is positive news. However, it is worth noting that the toy industry comes from competition in some other categories.

Children are expressing more and more excitement and interest in beauty products. A comprehensive survey of the carriage found that 46% of parents planned to give beauty products as gifts to their children under the age of 13 during the past holidays, and 79% of those parents said their children requested it. More than one-third (36%) of parents expect to buy cologne with their sons aged 13-17 during the holidays. As an industry, it is important to understand the entire range of what consumers want, as we think it may be attributed to some declines in these purchase shifts.

Kidult Market Kidult Market, aged 18 and older, continues to drive market growth for toys, up more than $800 million in 2024, according to Circana’s checkout. Female recipients account for about two-thirds of their gain, growing at twice the rate of men. Now, adults have annual toy sales of $7.6 billion. Additionally, consumers who make toy purchases themselves have the fastest growth in all segments, with the largest dollar growth – up 11% in 2024 and 2023. If we look at the fourth quarter, that growth is even higher. The adult market is a huge space opportunity for growth. Toys of this age are less permeable and if we can make the right toys for them, there are more adults to reach.

Entering the future

Steady tailwinds, such as growth in Kidult Space and spending on high-income households, balanced the headwinds in 2024, such as higher grocery prices and rising consumer debt. In 2025, I hope the toy industry will change from stability or consistency to creativity. We will have a lot of lineups of toy movies in 2025 and 2026 to stimulate growth in the industry and inspire young audiences.

While the toy industry does reach stability in 2024, I hope the new year will increase more stability across all product categories. Award-winning companies prove to the industry that creating fresh, innovative products and targeting potentially an untapped consumer base can play a role in this social media-driven world, and can even thrive. Manufacturers and retailers need opportunities to be able to identify these gaps and create innovations to fill that space.

Source: Circana, Retail Tracking Services, 2019-January 2024; Circana, Checkout Recipient Insights, January-December 2024.

Data represents retailers participating in Circana’s retail tracking services. Circana currently estimates that retail tracking services account for about 71% of the U.S. retail market.

Versions of this feature were originally published in the 2025 Big Toy Book. Click here to read the full question! Want to receive a printed toy book? Click here to get the subscription options!