Berachain is a well-known layer 1 blockchain that is expected to launch TGE at 13:00 UTC for the local token $BERA on most famous CEXs. Berachain’s appeal and predictions about the value of Bera tokens will be explained below.

appeal Belling

Berachain introduces a novel liquid proof consensus mechanism that is different from the traditional proof-of-proof-work (POS) or proof-of-work (POW) model. POL motivates users to provide liquidity to the network, thereby enhancing the liquidity of decentralized applications (DAPPS). This mechanism aligns the interests of validators, users and developers, thus facilitating a more interconnected and effective ecosystem.

It cultivates a strong community, partly because it originated from the NFT space, which includes projects like “Bong Bears”. The community support has translated into a huge funding and a vibrant ecosystem, and according to information on X, there are more than 270 projects dedicated to the network.

By embedding liquidity solutions into consensus levels, Berachain aims to address DEFI – one of the biggest challenges of liquidity decentralization. This approach not only ensures the network, but also enhances the functionality and appeal of building DAPPs.

This new layer 1 blockchain has Raised over $3.32 billion in liquidity Before the mainnet is released. This is achieved through the Boyco Vault program, which incentivizes users to lock in assets such as ETH and WBTC in exchange for Bera Airdrops. The overwhelming success of the program demonstrates the right Belling From the crypto community.

Belling Like lyezero Labs, there are partnerships designed to make It’s comprehensiveconnect it to more than 50 blockchains. This interoperability is crucial in the blockchain space for seamless assets and information transmission across different networks.

Blockchain supports a range of DEFI applications that decentralize communication (e.g. Belling Bex) to professional projects such as Apiarist Finance, and Boink for blockchain gaming, demonstrates its versatility and potential for widespread adoption.

Berachain Tokenomics

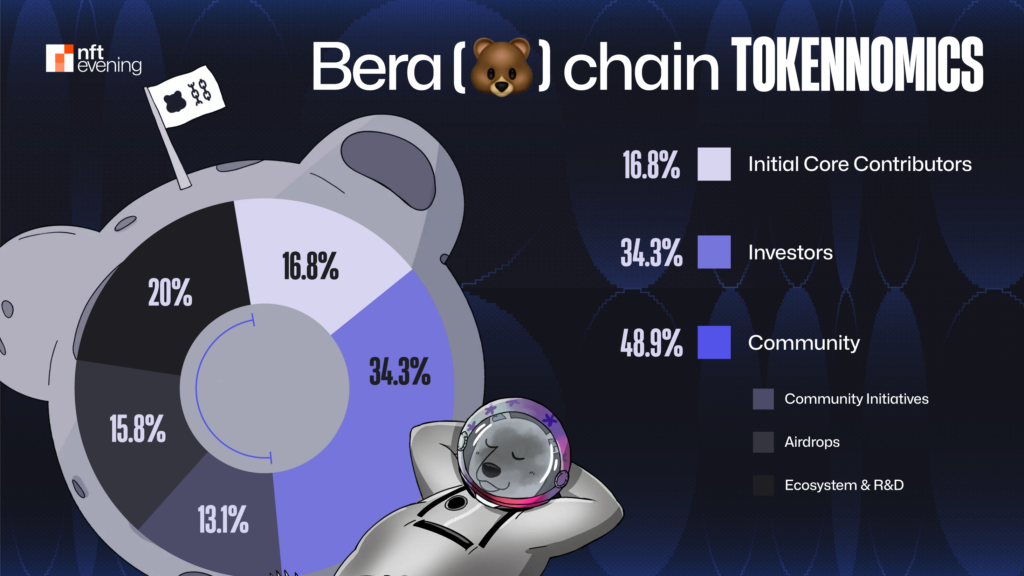

Token allocation:

- Ecosystem and R&D: 20%

- Community: 48.9%

- Airdrop: 15.8%

- Community Initiative: 13.1%

- Initial Core Contributors: 16.8%

- Investors: 34.3%

The initial circulating supply of $BERA is 107,480,000 bera (21.5% of the total supply) and the total supply is 500,000,000 bera.

BERA Release Schedule

BERA’s token allocation schedule is considered fairly reasonable. After a year of cliffs, 1/6 of the allocated tokens were unlocked. The rest will be subject to linear attribution over the next 24 months.

BERA price forecast

Berachain: Promising Layer 1 Blockchain

The famous blockchain Berachain has cultivated a thriving ecosystem and community for a long time. Therefore, there are great expectations around the gas disk of the farmers’ team and the token price scale of TGE.

Market environment and comparison

- SUI Network: The Layer 1 blockchain was launched at a full dilution valuation (FDV) of $13.9 billion, but then experienced a decline due to market conditions and liquidity constraints.

- Super fluid: This item is a bullish indicator. On TGE, $hype closed for $14.1 billion that day and quickly soared to a staggering $42.1 billion in a few days.

The potential of Berachain

Favorable market opportunity: Berachain’s mainnet release coincides with the gradual recovery of the cryptocurrency market, which could be affected by President Trump’s re-election, which could lead to relaxed crypto regulations and introduce fresh liquidity into the cryptocurrency market.

Strategic token listing: Unlike recent trends, the token is launched with an exaggerated valuation, followed by a dump that benefits venture capital firms, $bera has been listed on the major CEX to ensure liquidity. This suggests that the possibility of $bera launch is comparable to Aptos or Mantra (currently around $7 billion – $10 billion). Given the market conditions, this range seems reasonable and can provide a buffer for the role of space and a well-known long-term growth orientation.

Reaching current milestones Super fluid (hype), a fully diluted valuation (FDV) reaches $25B, which will be very challenging. Super fluid is self-sufficiency tier 1 because it does not require the funds of venture capitalists (VCs) or the listing fees and liquidity of CEXs. This means that the source of the generated funds depends entirely on the user’s transaction volume Super fluid Granted excellent abilities. 31% of the total supply supply provided air conditioners to users, but in return, from TGE to all-time highs (ATH), the token price has steadily risen. Instead, Berachain hasn’t appeared on TestNet until recently and has just begun deploying on Mainnet, so it’s unlikely to apply BERA’s price trajectory to Bera’s price trajectory.

There are two most likely scenarios: Bella can list stable FDVs (compared with Aptos and Mantra) to face initial temporary price dump pressure and then grow long term, or use Hyperliquid’s current FDV ($25B) Listed, this will be as shown in many previous cases, with an extremely high number to meet the interests of VC and communication.

However, it should be noted that these are speculations and should not be used as investment advice.