Donald Trump, a staunch cryptocurrency advocate, took office as President of the United States on January 20. The move reaffirms its commitment to other countries to “Make America Great Again” and signals an optimistic outlook for the cryptocurrency environment.

Trump shows friendliness towards cryptocurrencies

Source: NBC News

regulatory changes

Trump promised to be the “most crypto-friendly president” and made several promises that could impact regulation:

- Fire Gary Gensler: Removing the current SEC chairman, who many in the cryptocurrency space believe will stifle innovation, could lead to a more favorable regulatory environment. Trump’s pick to lead the SEC, Paul Atkins, is known for his pro-cryptocurrency stance and is active as CEO of consulting firm Patomak Global Partners, which frequently advises on how to leverage digital currencies for cutting-edge Cryptocurrency companies and traditional financial companies offer recommended growth assets.

- National Bitcoin Reserve: The idea of a government Bitcoin reserve has been floated, which could theoretically increase demand for Bitcoin, but its feasibility has been questioned. While President Trump’s inauguration may lead to more “comfortable” cryptocurrency regulation, united telegraph According to reports, some aspects, including stablecoins, still need time to adjust.

- Boosting US Bitcoin Mining Industry: During the July 2024 campaign, at a Bitcoin conference in Nashville, Donald Trump promised to encourage domestic Bitcoin mining operations, which he believed could support the industry in America’s growth.

- Regulatory Clarity: It is expected that the new government may provide clearer and more favorable regulations for cryptocurrencies, which may lead to increased institutional investment and mainstream adoption. ETFs are currently the basis for the legalization of cryptocurrencies and are also a bridge that guides the flow of funds from the TradFi (traditional) market to the cryptocurrency market. However, the amount of money held by people is much larger and a legal basis is needed to open investment doors for US citizens on multiple platforms, which is being applied in Europe under the name MiCA.

Read more: Best Cryptocurrency Exchanges in the United States for January 2025

Trump’s positive impact on cryptocurrencies

First, it’s important to emphasize that Trump’s entire presidential campaign has been a long-term effort to convince the cryptocurrency community to embrace his crypto-friendly policies. As a result, market prices often fluctuate based on his actions and comments.

When Trump won the presidential election on November 5, 2024, the cryptocurrency market entered an overwhelmingly positive phase. Bitcoin, which had fallen for six consecutive days, quickly rebounded and continued its upward momentum after Trump’s victory. This event is considered a significant catalyst, setting the stage for BTC to break out to new all-time highs (ATH) in the coming days.

Altcoins often follow Bitcoin’s price trends. As a result, the total cryptocurrency market capitalization surged from approximately $2.29 trillion in early November to a new milestone of $3.73 trillion.

Donald Trump is close to Elon Musk, the billionaire entrepreneur behind Tesla and SpaceX, who is known for his tweets that have a significant impact on cryptocurrency prices. Dogecoin ($DOGE) is a prime example of this influence.

Recently, Trump signed an executive order approving the establishment of the Department of Government Effectiveness (DOGE) led by Elon Musk, a name that immediately brings to mind Dogecoin.

Days before the inauguration, Trump announced the launch of a new meme coin called $TRUMP. In just 36 hours after its release, the token quickly surpassed several major technology projects and reached a market capitalization of $15 billion, becoming the second-largest meme coin after Dogecoin. Since $TRUMP is a Solana-based token, the price of $SOL surged to an all-time high of $294.33 last Sunday. This dramatic growth may reflect growing investor confidence in the Solana ecosystem, likely driven by the success of $TRUMP and the fact that some retailers have also joined $MELANIA.

Read more: How to Buy Solana (SOL) – 2025 Guide

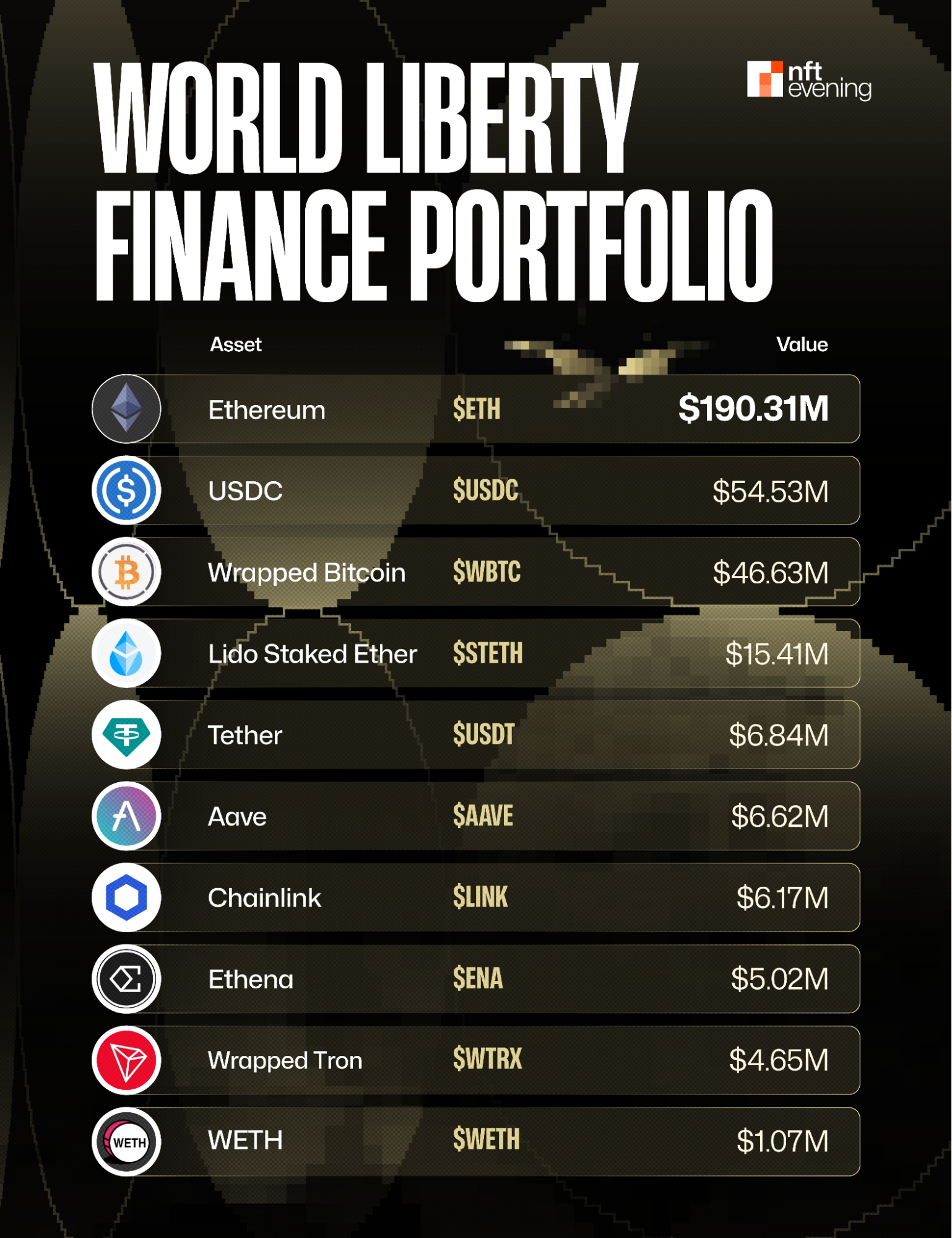

World Liberty Financial, an independent Trump-related cryptocurrency initiative, revealed on Monday that it successfully completed its initial coin sale, securing $300 million in funding, and will consider issuing an additional 5% of its tokens due to high demand. Currently, the funds behind Trump are gradually stepping up their purchases of major currencies, including $ENA, $ETH, $AAVE or $LINK.

Read more: Best Cryptocurrency Exchanges in the United States for January 2025

World Free Financial Portfolio

The intention behind the launch of $TRUMP

The $TRUMP memecoin is designed to resonate with Donald Trump’s supporters by leveraging his political persona and the Make America Great Again (MAGA) slogan. This makes it a cultural phenomenon, aligned with meme culture, while also serving as a political statement or symbol of support for Trump’s ideology and policies. This is evident from posts on X, which users describe as emblematic representations of political movements or sentiments associated with Trump.

Given its rapid rise in value and huge market capitalization shortly after its issuance, Trumpcoin appears designed to leverage Trump’s brand and influence for financial gain. There are reports that a significant portion of the token’s supply is controlled by entities associated with Trump, suggesting a direct financial interest behind its success. The token’s market dynamics, including its initial spike and subsequent volatility, highlight its status as a speculative asset rather than one with intrinsic utility.

This meme coin could also engage and mobilize Trump’s community, not only financially but also in terms of participation in the cryptocurrency ecosystem. The launch was announced by Trump himself on social media platforms, signaling his intention to involve his followers directly in the project. It’s worth noting that such tokens often attract investment because of the hype they generate, even if they lack fundamental value. This aspect of speculation and community interaction is crucial to memecoins, which thrive on social media attention and enthusiastic virality.

However, the timing and manner in which $TRUMP was launched raises ethical concerns, especially given that Trump is about to return to office with a pro-crypto agenda. Critics have pointed to potential conflicts of interest, with Trump potentially influencing regulations or policy in a way that would benefit his financial interests in the coins. This has sparked discussions about the ethics of politicians initiating such businesses, especially in the context of regulatory scrutiny of cryptocurrencies. CNN.

Bull season 2025?

Typically, after Bitcoin completes its halving cycle, Bitcoin and the broader crypto market will grow significantly the following year. This trend has been consistently observed during the 2012, 2016, and 2020 halving events, with the next halving expected to occur in 2024. Strong upside potential.

Public confidence in cryptocurrencies is driven by more than just their cyclical nature. Trump’s re-election opens the door to the legalization of Bitcoin and other cryptocurrencies, making it easier for large amounts of investor liquidity to flow into the crypto market.

One notable example is Coinbase, a pioneering American cryptocurrency exchange led by Brian Armstrong, which recently announced delays in processing withdrawals of the Solana network and $SOL tokens due to overwhelming $SOL-related FOMO (fear of missing out).

The launch of $TRUMP, a token based on the Solana blockchain, triggered a surge in demand for $SOL as users required the token to purchase or trade $TRUMP. The surge in demand temporarily limited the supply of $SOL on Coinbase as users moved the token off the platform to participate in trading of the new memecoin. Speculative investors may move $SOL away from Coinbase to take advantage of the growing hype, either buying $TRUMP or holding $SOL in anticipation that the craze surrounding the token will send the price surging.

The congestion of Coinbase’s $SOL supply caused by 36-day meme coins like $TRUMP caused major problems. If the massive liquidity from the US market continues to pour into other projects, how many coins will experience similar or even larger price surges? It is worth noting that, according to a Recent surveys conducted by NFTeveningMany Americans admit that $TRUMP was their first cryptocurrency investment.

Additionally, as the U.S. increasingly opens its doors to cryptocurrencies amid unprecedented fear of missing out, it’s worth asking whether other major countries, including China and Russia, will remain passive observers . The ongoing cryptocurrency season will bring more excitement and opportunities for investors.

U.S. Coin Project Will Gain Most Significant Gains

The election of Trump as president in November 2024 has triggered positive speculation on the cryptocurrency market. This speculation led to a sharp rise in the market, along with a strong performance for US-related coins:

- $XRP (ripple): +564% (all-time high)

- $XLM (Stellar): +579% (all-time high)

- $BTC (Bitcoin): +61% (all-time high)

- $SUI (Sui): +192% (all-time high)

- $SOL (Solana): +91% (all-time high)

Ecosystem of US-related coins provided by MarketCap

Additionally, there have been discussions and proposals suggesting tax incentives for U.S. cryptocurrencies. For example, there has been speculation about capital gains tax exemptions for certain U.S. cryptocurrencies, which would significantly benefit token holders by reducing their tax obligations. In order to attract liquidity among citizens, the US environment allows the creation of new financial instruments through tokenization, which can provide unique investment opportunities as well as ETFs and ETPs not available in traditional markets. This innovation can lead to tokens with novel advantages or use cases.

final thoughts

A Trump presidency could spur a significant expansion of the U.S. cryptocurrency ecosystem, making the country a global leader in blockchain technology. However, the long-term impact will largely depend on how these policies are implemented, their global acceptance, and the balance between promoting innovation and ensuring market integrity.

Sentiment among the crypto community on social media appears to be optimistic about the immediate impact of these policies, but cautious about their sustainability and long-term consequences.