1.What is Thena(THE)?

Xena(THE) It is a decentralized exchange (DEX) and liquidity platform running on the BNB chain and opBNB. It simplifies token exchange, cross-chain transfers and liquidity management, creating a seamless experience for DeFi users.

imagine

Thena aims to revolutionize decentralized finance by becoming the ultimate “super application” for on-chain users, providing a seamless CEX-level experience in a fully decentralized environment.

The platform’s vision goes beyond trading, positioning itself as the most adaptable liquidity layer in the ecosystem. Thena is designed to serve the wide range of liquidity needs of its partners, including stablecoins, Liquid Collateral Tokens (LST), tokenized real-world assets (RWA), memecoins, AI tokens, and more.

2.Thena Ecosystem

Spot DEX

Thena’s Spot DEX provides users with fast, low-cost exchange of various digital assets. It is powered by ODOS routing technology, which ensures optimal trading with minimal slippage through the Thena liquidity pool, all within a secure and user-friendly interface.

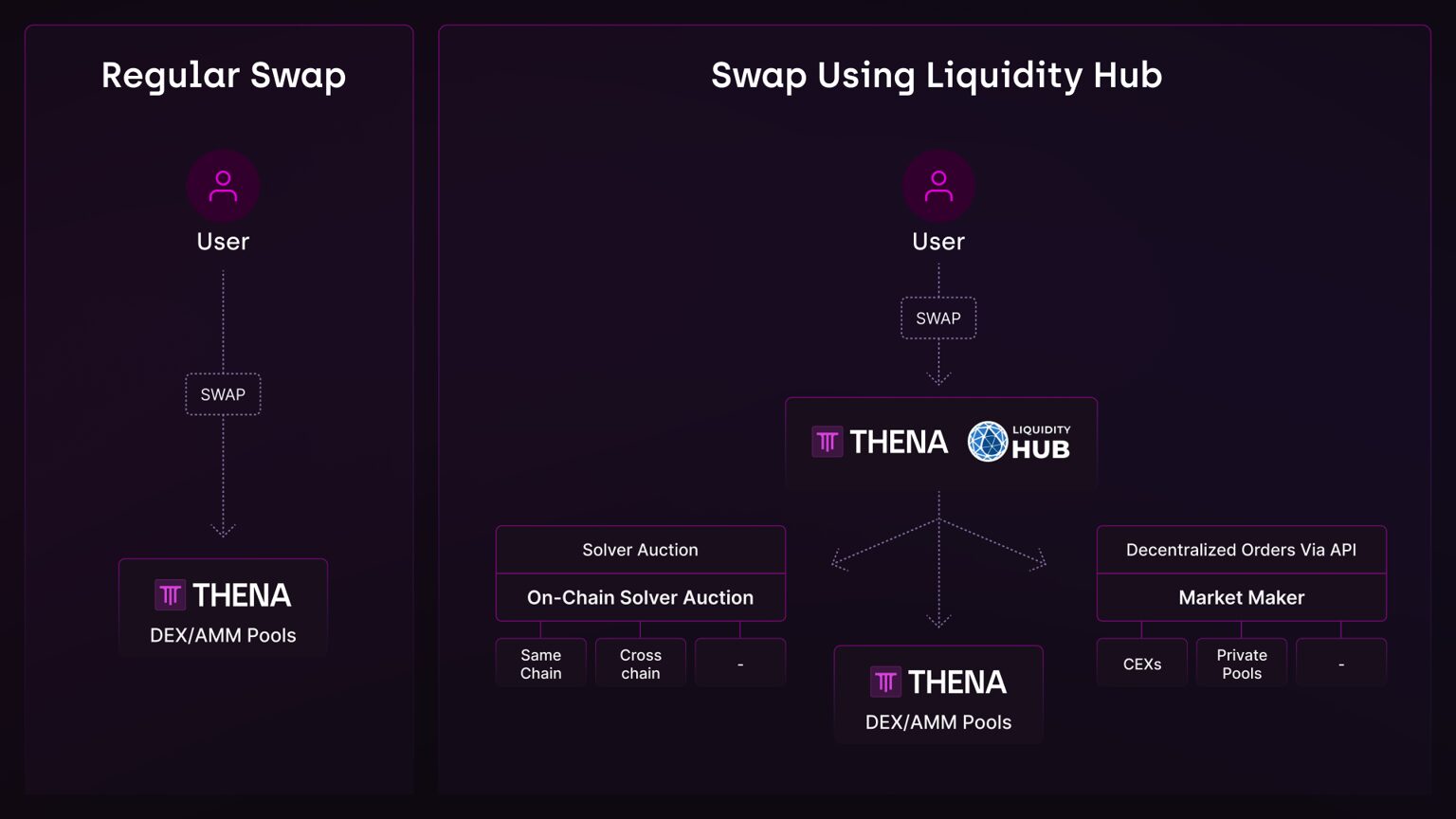

The platform also integrates the ORBS Liquidity Center, an advanced optimization layer that leverages external liquidity sources to achieve better price execution and reduce price impact. If an external source cannot provide a better exchange rate, the trade will seamlessly default to execution using Thena’s AMM contract.

ALPHA: Eternal DEX

ALPHA is a cutting-edge perpetual DEX created by Thena, offering up to 60x leverage on over 150 crypto assets.

The platform uses the Automated Quotation Market (AMFQ) engine to combine the order book and AMM to improve capital efficiency. Through isolation of counterparty risk and collateral support protocols, ALPHA ensures a secure and trustless trading experience.

ARENA: Where SocialFi meets trading

ARENA is a social hub for trading competitions, fully integrated into the Thena ecosystem. It allows whitelisted partners to create customizable, permissionless trading competitions on spot and permanent markets.

ARENA is designed as a growth hacking tool that helps partners increase community engagement, increase brand awareness, and drive user acquisition and retention. It also enhances website traffic and deepens liquidity within Thena, providing valuable benefits to partners and users.

WARP: Launchpad for upcoming launches

WARP is an upcoming launchpad in the Thena ecosystem designed to support new projects and tokens. It will provide a platform for innovative enterprises to launch, gain exposure and develop in the DeFi field, helping to cultivate the next wave of decentralized projects.

3. Main features of THENA

ve(3,3) governance model

Inspired by Solidly and Aerodrome, THENA’s emissions distribution system enables veTHE holders to vote on liquidity pool incentives. This model promotes coordination among stakeholders and promotes an efficient and sustainable ecosystem.

Advanced liquidity tools

THENA V3,3 introduces cutting-edge features such as plug-ins (comparable to Uniswap V4’s Hooks), modular design, weighted pools, and metastable pools. These tools enhance customization and optimize liquidity management.

Cross-chain governance

THENA starts with opBNB and extends its governance structure to multiple networks. This enables veTHE holders to develop liquidity strategies that transcend a single blockchain.

Community driven success

THENA operates without venture capital and has redistributed over $25 million in gross revenue directly to token holders. Its growth is driven by its community and strategic collaboration with ecosystem partners.

4.Thena Token Economics

Through its $THE utility token, veTHE governance token (as an NFT) and theNFT series, Thena creates a sustainable and beneficial ecosystem for users, liquidity providers and token holders.

$THE – BEP-20 Utility Token

$THE is the core utility token of the Thena protocol. It is mainly used for:

- Promote liquidity: Issued as farming rewards to encourage deep liquidity for optimal trading.

- Decentralized governance: $THE can be used for platform governance and supports the path to decentralization.

veTHE – Governance Token (NFT)

veTHE is a voting escrow version of $THE, issued as an NFT. Users lock up $THE tokens for up to 2 years to receive veTHE. The longer the lock-up period, the greater the voting rights.

- Dynamic rewards:veTHE balance decreases over time, promoting continued participation.

- revenue share: veTHE holders earn 90% of transaction fees and 10% of protocol voting incentives.

theNFT – Founder’s Token (NFT)

theNFT is a non-dilutive collection that allows for revenue sharing through staking.

- revenue share: Staking an NFT provides holders with 10% of the total transaction fees and royalties on secondary sales of the NFT.

5. Binance airdrops Thena Token (THE) on HODLER

Symbol: this

Blockchain: BNB chain

Smart contract: 0xF4C8E32EaDEC4BFe97E0F595AdD0f4450a863a11

Current price: $3.67

Market capitalization: $281.61 million

Circulation supply: 78.14 million

Data taken from coin market capNovember 28, 2024

Token distribution

Thena’s initial token distribution structure is as follows:

- User and partner airdrop: 25%

- Ecosystem Development Fund: 25%

- Protocol airdrop: 19%

- Development team: 18%

- TheNFT minter: 9%

- Initial liquidity reserve: 4%

Token issuance schedule

$THE issues 2.6 million tokens every week, with the issuance decreasing by 1% every week. The purpose of this gradual reduction is to control token inflation over time. The ultimate impact of this approach on the ecosystem will depend on user engagement and protocol activity.

- Weekly emissions: 2,600,000 THE (1% reduction per week).

- Maximum supply based on 1% weekly decay: 310,000,000 $THE.