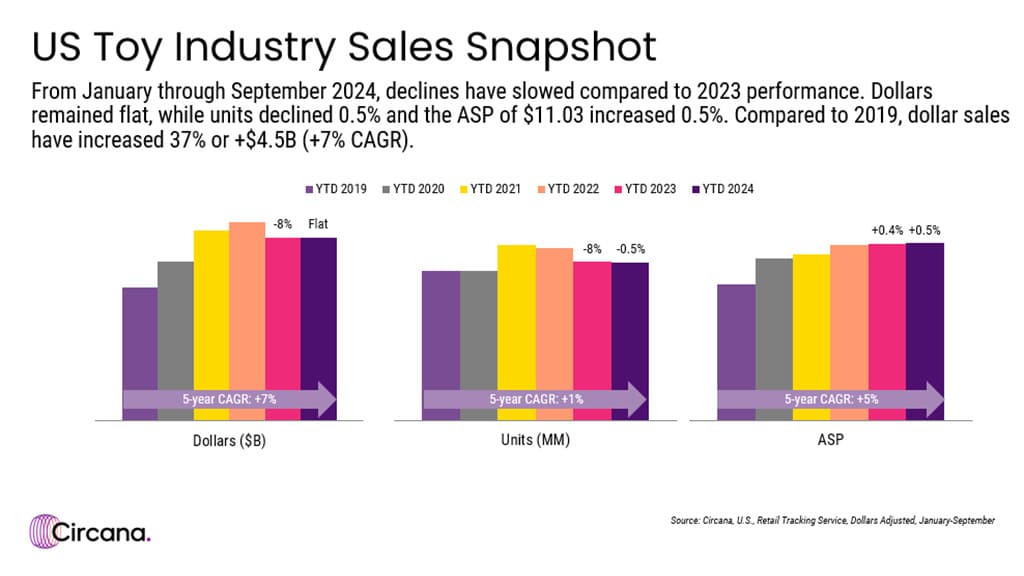

There is positive news from the U.S. toy industry. Circana, a global company that provides data and analytics on consumer behavior, reported that the industry improved from January to September this year. Sales were up 37%, or $4.5 billion, from 2019 sales and should continue to grow throughout the holiday season.

Building sets were the only category to grow in terms of dollars, units and average selling price (ASP). LEGO Botanicals is primarily driving this growth. Lego isn’t the only company growing. Growth also increased in exploratory toys, plush toys and vehicles (led by NBA cards, Hello Kitty and Monster Jam, respectively).

Growth in Outdoor Toys, Dolls & Action Figures declined, but at a lower rate in dollars and units compared to January-September 2023. No change compared to the same period last year.

“At the beginning of this year, I made ‘consistency correction’ a theme for 2024, and in the third quarter, the toy industry reached the level of stability we have been working towards,” said Juli Lennett, vice president. “However, positive performance is still concentrated in a small number of categories; what we need is stability across the board.

Holiday spending is expected to boost sales across the board. Consumers plan to spend 2% more this year than in 2023, according to Circana’s annual holiday purchase intentions report. Millennials and buyers with children plan to spend the most this holiday season. “The toy industry is likely to get a boost this holiday season, with 43% of households with children saying they will spend more during the holidays this year compared to last year, more than double the rate of households without children,” Lennett said. Although it plans to invest more in toys, other categories such as clothing, smartphones and beauty will still pose challenges to the toy industry.