2024 is an eye-opening year for the NFT space, and as the market develops, some worrying patterns have come to light. The market is trying to maintain its previous momentum, with a surge in new series, low participation, and sharp price drops. We find the truth by observing the performance of 29,079 newly dropped NFTs in 2024. Let’s explore the facts that tell this story.

Key insights:

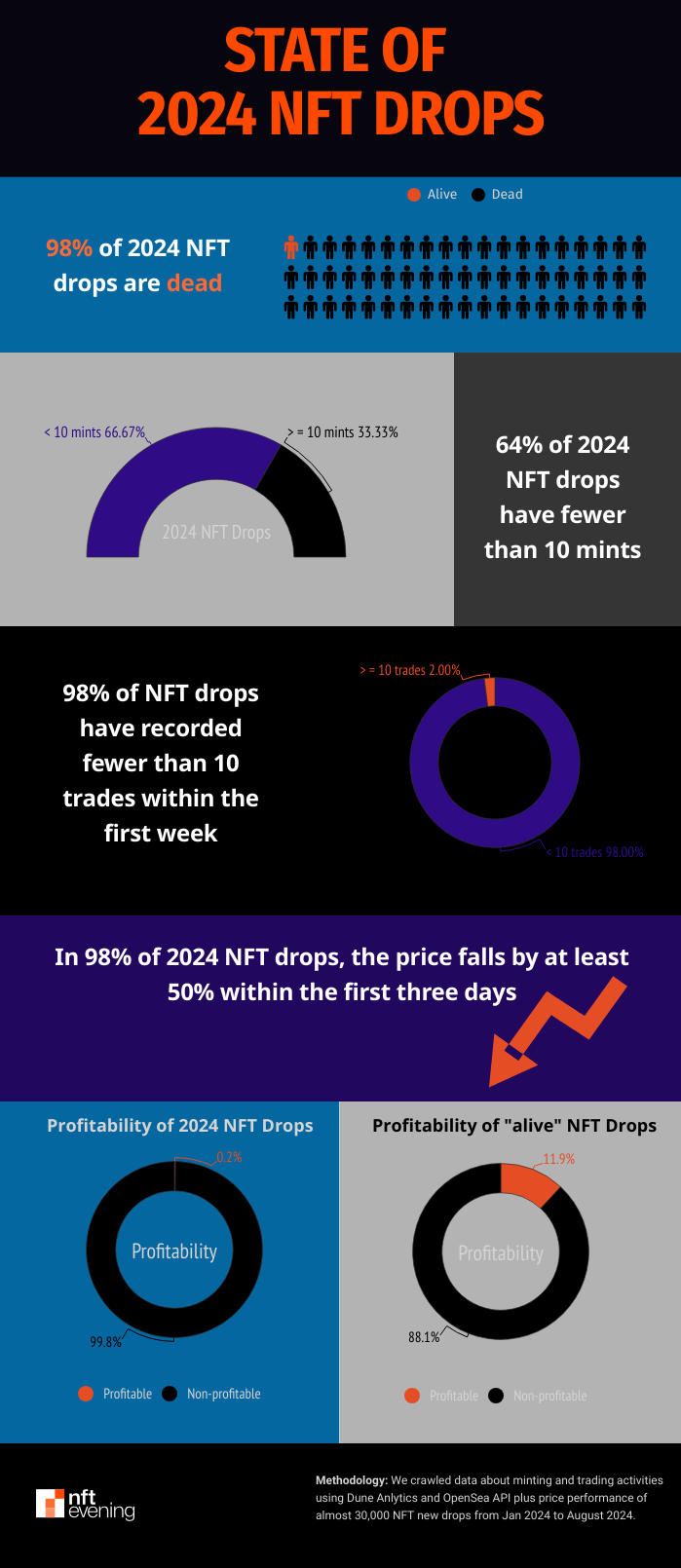

- 98% of NFT drops in 2024 are dead.

- Only 0.2% of NFTs in 2024 will reduce investor return profits.

- 64% of 2024 NFT drops will have fewer than 10 units.

- 98% of 2024 NFT drops had less than 10 transactions in the first week.

- Of the 98% of NFT declines in 2024, the price fell by at least 50% in the first three days.

- 84% of the ATH prices in 2024 NFT drops are equal to the mint price.

methodology

Source: Dune Analytics and OpenSea.

- First, we collected different NFT contracts from Dune that had minting activity between January 1, 2024, and August 31, 2024. We then double-checked the data using the OpenSea API to ensure its accuracy.

- Next we use Dune Analytics for crawling analysis:

- The mint price, ATH price, current price, and price three days after mint have all been concluded.

- 7D Mint Volume, 7D Transaction Volume, and Transaction Volume since September.

Market is oversaturated

An average of 3,635 NFT collections created per month so far in 2024. While this shows that creators are still eager to launch projects, the sheer volume of collections suggests that the market is oversaturated. Supply far exceeds demand, leaving many projects struggling to attract attention and buyers.

98% of NFT drops in 2024 are dead

We define death as no trading activity since September 2024.

Based on this, we can draw this conclusion: 98% of NFT drops in 2024 are dead.

This shows how quickly projects can fail, resulting in many collections lacking liquidity, community or trading activity. The survival rate for new drops is astonishingly low, suggesting that most NFTs struggle to stay relevant soon after release.

Things get even worse when we delve deeper into these three numbers: mintage, transactions, and price.

Low minting and trading activity

Despite the large number of new collections, 64% of NFT drops in 2024 will be less than 10 pieces. This stark number highlights the difficulty most creators face when launching a project. also, 98% of NFT drops have fewer than 10 transactions in the first week. The limited trading volume indicates a lack of excitement or confidence among investors in these projects.

Such low levels of engagement suggest that many collections fail to resonate with audiences, possibly due to a lack of uniqueness, usefulness or perceived value. The rapidly growing NFT trend threatens to leave creators competing in an overcrowded market in which standing out has become an uphill battle.

Prices fall rapidly

One of the most worrying trends in 2024 is the rapid depreciation in NFT value after launch. 98% of the declines in 2024 have followed the same pattern: price fell by at least 50% in the first three days.

This sharp decline reflects waning buyer enthusiasm and a lack of long-term interest in holding these digital assets.

and, 84% of all-time high prices for 2024 NFT drops match mint pricemeaning they never appreciated in value. In a market where speculative trading was once rife, the trend suggests buyers are either losing confidence or becoming more selective about the projects they back.

Only a small part brings returns

Only 0.2% of all NFT drops resulted in profits for investors in 2024. even Of NFTs that are still actively traded (“active” NFTs), only 11.9% have proven profitablereflecting the overall difficulties faced by most projects. This data reveals how selective and cautious investors need to be, as the vast majority of NFTs struggle to maintain or grow their value, making profits a rare outcome in the current market landscape.

What does this mean for the future?

The data paints a clear picture: while NFTs remain a vibrant innovation space, the market is currently flooded with projects that are struggling to find traction. Due to over-saturation, low mint rates, and poor value for money, creators may need to rethink their strategies and focus on building community and providing real utility to stand out.