Circana revealed that U.S. toy industry sales stabilized in the first half of this year, according to its retail tracking service.

From January to June, dollar sales in the toy industry remained stable compared with the same period last year, when the market fell by 8%. The broader picture shows that toy sales are still 38% higher than 2019 levels. According to data from Circana’s retail tracking service, three of the 11 toy supercategories grew during this period. Building sets are a strong front-runner, with sales continuing to grow, with sales up 25%. This is primarily driven by the LEGO icon and appeal to adults.

Following building sets, the Discovery Toys and Other Toys super category followed, growing 9% due to the popularity of NBA and BFL trading cards. The Vehicle Super category was driven by Monster Jam and also contributed to dollar growth. Two other super categories with sales growth are stuffed toys, outdoor toys and sports toys. Four of the top 10 toy industries by sales—including Barbie, Lego Icons, the NFL and the NBA—have grown.

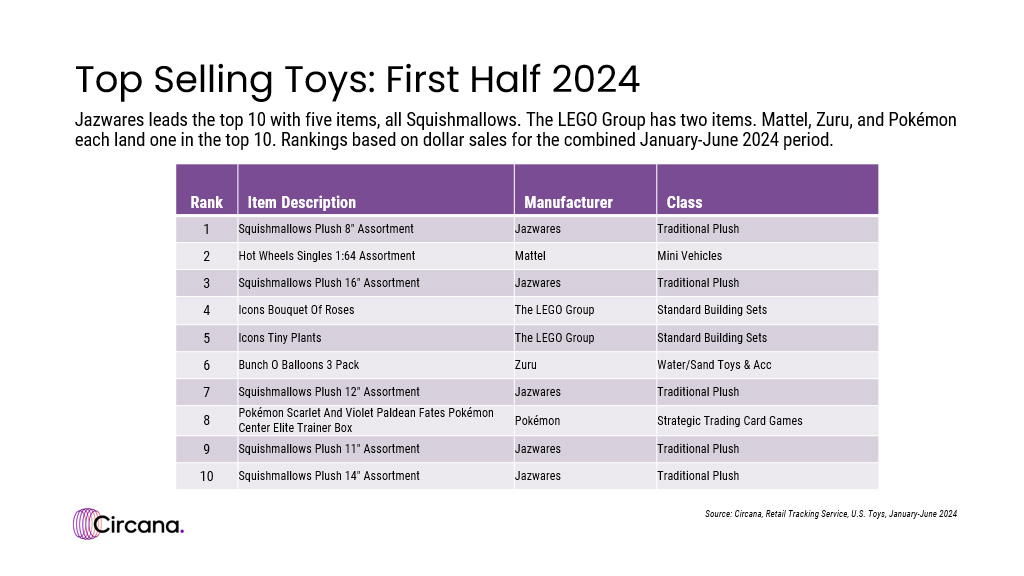

The best-selling toys overall during this period appear to be Jazwares’ Squishmallows (which dominates the top 10 best-selling toys) as well as products from Zuru, Mattel, the LEGO Group, and The Pokémon Company International.

“As toy sales begin to stabilize in 2024, industry trends are shifting and we are moving from a correction to a stable state,” said Juli Lennett, Circana vice president and U.S. toy industry consultant. “However, it is important to note that this is not the case. Smooth sailing for the second half of the year. While inflation has begun to cool, unemployment, record consumer debt, student loan repayments and swings in consumer confidence should be closely monitored to reflect how consumers are feeling and potentially changing their spending.

For an in-depth look at this year’s U.S. toy industry sales figures, check out the September 9 issue of The Toy Book’s Los Angeles Fall Toy Preview.