Crypto payments are no longer a niche phenomenon. Their growing adoption means a critical shift, highlighting the central role of cryptocurrencies in global commercial transactions. In this study, Nftevening collaborated with Storbible to explore global cryptocurrency payments and their benefits to businesses.

Key Discovery

- In 2024, 12,834 merchants around the world accepted cryptocurrency payments, a 50% increase from 2023.

- 88% of businesses report higher revenues after accepting crypto payments.

- 76% of business owners prefer to hold cryptocurrencies instead of converting to Fiat right away.

- 5,677 businesses in Europe accept crypto payments, leading the world.

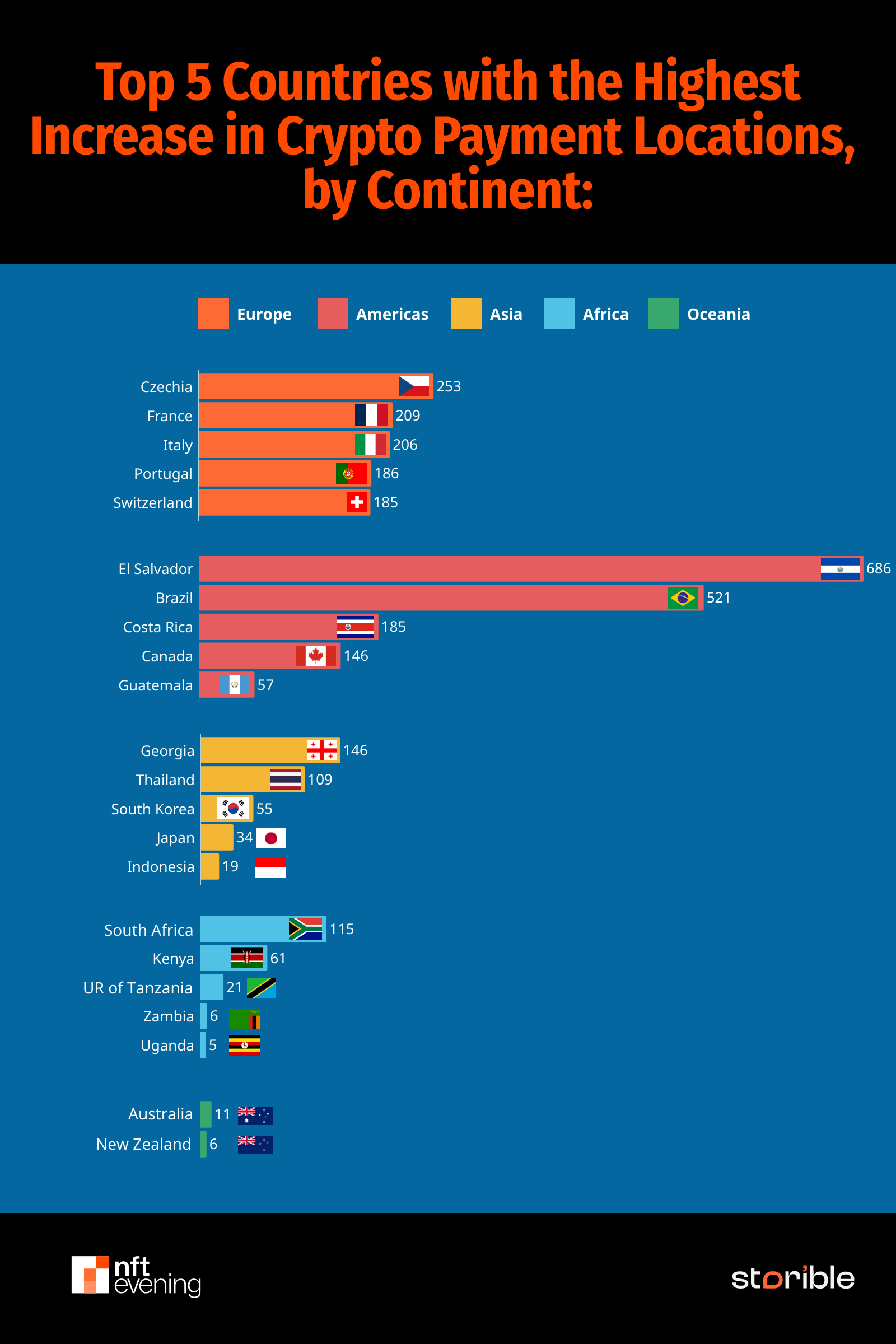

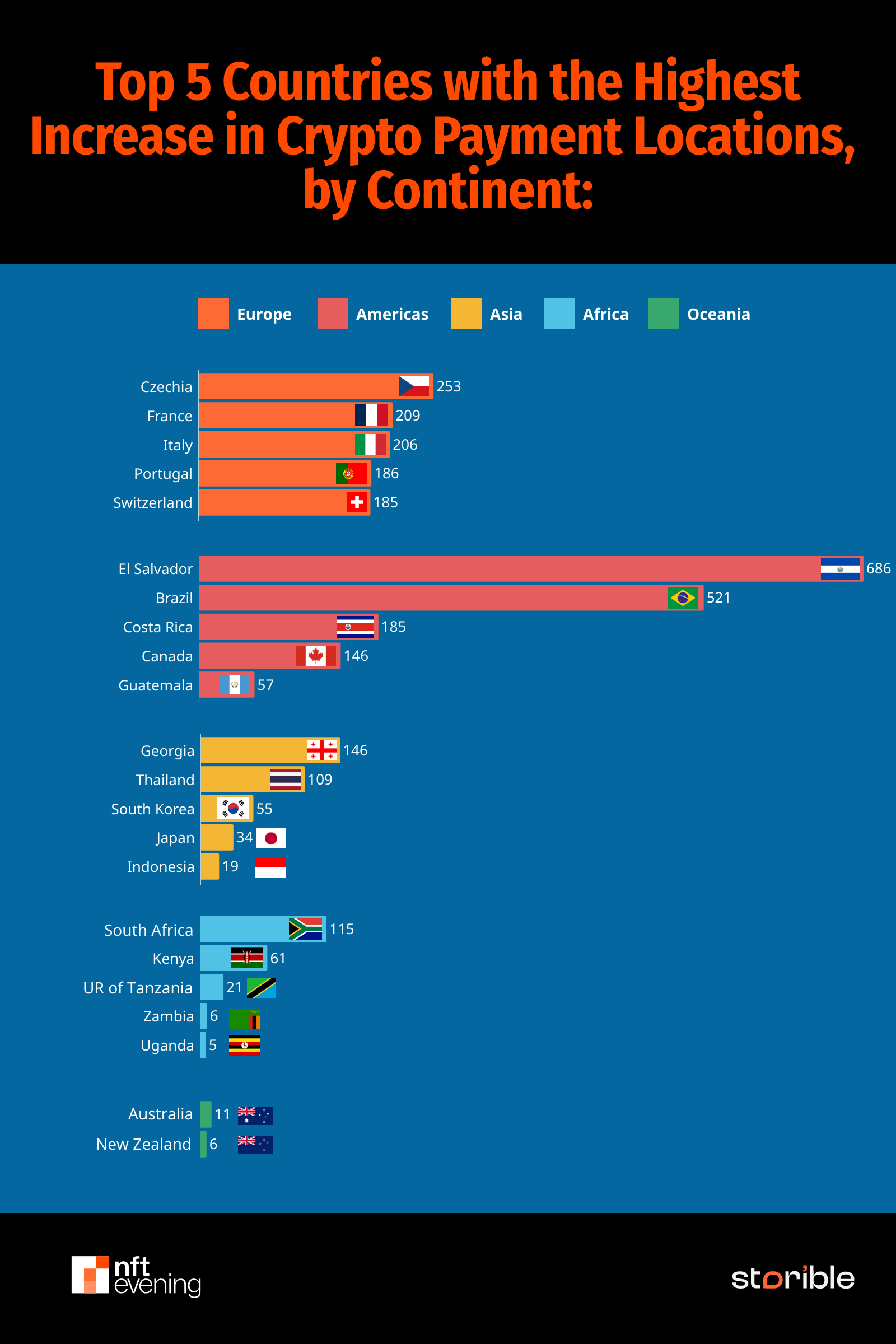

- In 2024, El Salvador’s acceptance of cryptocurrency payments increased the most, with 686 locations added.

- The most popular company is Brazil, with 1,292.

Methodology

To map global adoption of crypto payments, we collected data from btcmap.org. Additionally, to gain more in-depth insights from businesses that accept cryptocurrencies, we surveyed 1,009 business owners who consolidated cryptocurrencies through prolific platforms.

Data collection takes place between February 28 and March 7, 2025.

Global crypto payment explosion

Global business adoption surged sharply, from 8,571 in 2023 to 12,834 in 2024, a figure that rose by nearly 50%. Europe led the charge, with 5,677 locations, followed by the Americas with 5,362.

Europe remains the center of cryptocurrency payments, with the highest number of location numbers (2,029 new locations), which emphasizes the region’s openness to a crypto-friendly business environment. However, the highest percentage increase in Asia (73%) indicates rapid expansion of acceptance.

Europe remains the center of cryptocurrency payments, with the highest number of location numbers (2,029 new locations), which emphasizes the region’s openness to a crypto-friendly business environment. However, the highest percentage increase in Asia (73%) indicates rapid expansion of acceptance.

Businessman embraces cryptocurrency for higher profits

Businesses that accept crypto payments are making huge gains. A compelling 88.2% of business owners reported increased revenue after the introduction of cryptocurrency payment options. Interestingly, 75.7% of businessmen choose to retain their cryptocurrency earningsreflects confidence in the long-term value of cryptocurrencies.

Three main reasons why companies accept encryption include:

- Faster, borderless payments (40.7%) – Businesses recognize the efficiency of cryptocurrencies to quickly handle international transactions without traditional financial barriers.

- Customer demand (29.8%) – More and more crypto consumers directly affect business practices.

- Asset accumulation (21.0%) – Merchants aim to accumulate crypto assets.

Regional Leader for Crypto Payments

Brazil stands out globally, leading 1,292 crypto payment locationshighlighting the vibrant Latin American crypto market. The United States and El Salvador followed closely, emphasizing the dominance of America.

The crypto payment landscape shows different regional leaders.

- Europe: Italy leads 909 cryptocurrency payment locations, followed by Czech Republic (881), Switzerland (560), Germany (546) and Netherlands (345), reflecting a strong integration of cryptocurrency payments in Europe.

- America: Brazil stands out globally, leading 1,292 cryptocurrency locations, highlighting Latin America’s growing crypto enthusiasm. The United States (1,088 locations) and El Salvador (1,024 locations) highlight the region’s famous crypto adoption.

- Asia: Georgia is topped by 269 locations, followed by Thailand (171), the Philippines (77), South Korea (55), and Japan (54), showing a significant growth in the Asian crypto ecosystem.

- Africa: South Africa dominates 584 locations, indicating a rising crypto adoption in Africa.

- Oceania: Australia leads 139 locations, highlighting the integration of Oceania’s cautious and stable crypto payment methods.

Countries that accelerate the crypto payment revolution

El Salvador has experienced the most dramatic growth in the world, with its crypto-friendly locations ranging from 338 in 2023 to 1,024 in 2024– Vividly demonstrate the change potential of cryptocurrencies in emerging economies. Brazilian and Czechs also marked a significant increase.

The top 5 countries with the highest growth in crypto payment locations on the African continent:

- Europe: Jesse led the growth of Europe with 253 new locations, followed by France, especially after not having added 209 new locations after the previous year.

- America: El Salvador has the highest jump, adding 686 locations. Brazil followed closely behind with 521 locations added.

- Africa: South Africa has the highest growth in mainland China, adding 115 new crypto payment locations.

- Asia: Georgia ranks as an Asian country, adding 146 new locations, and Thailand is also famous, adding 109.

- Oceania: Australia has the highest growth, adding 11 new crypto-friendly locations.

in conclusion

The rapid expansion of cryptocurrency payments has highlighted the undeniable momentum of crypto in reshaping global commerce across continents and countries. Businessmen not only recognize immediate trading benefits, but also recognize the strategic advantages of asset accumulation. As adoption rates soar, especially in emerging economies, crypto payments are ready to redefine the future of global financial interactions, emphasizing efficiency, inclusion and financial innovation.