The hyperliquidity three whales accounted for a staggering $1 billion on Bitcoin with 40 times leverage, demonstrating strong confidence in price increases, while CryptoQuant’s chain data supports a healthy bull market with potential for further growth.

Three Whale’s $1B Bitcoin long position is crazy in the super-liquid mixing market

On May 21, 2025, Sanjing opened a long Bitcoin location 40X Leverage leverage ratio, dominates amazing Positions of $1.03 billion.

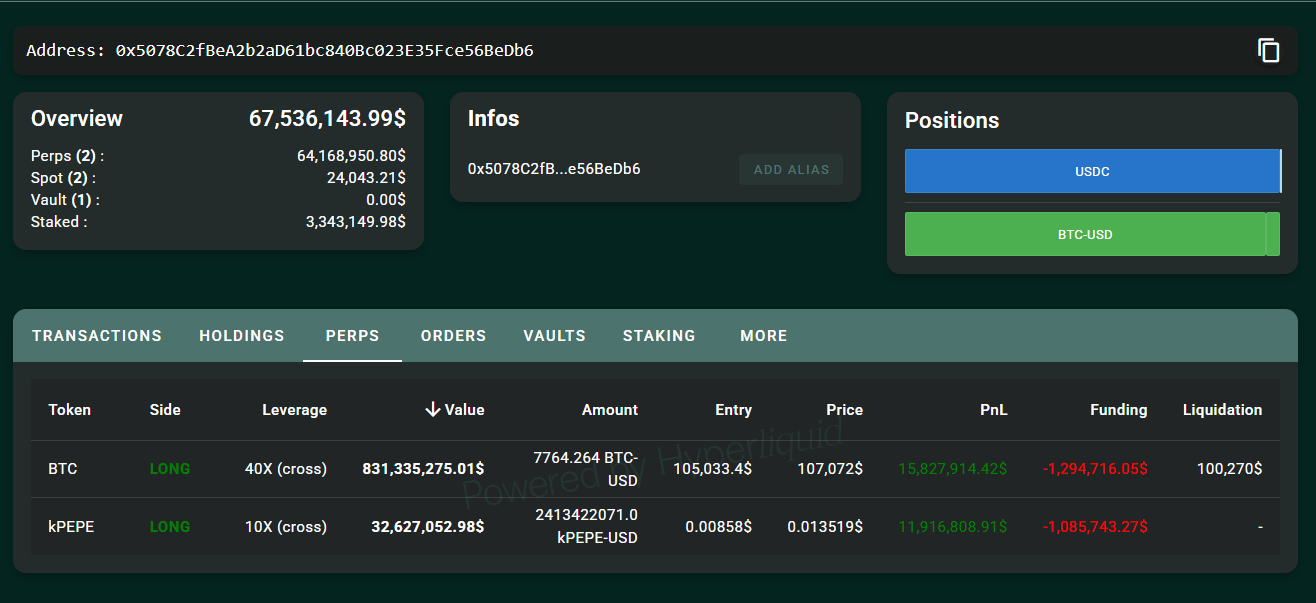

The first whale, identified as 0x5078, has a price of $105,033.4 for a desire BTC, and is currently up $15.83 million and a liquidation price of $100,270.

Source: Super Mobile

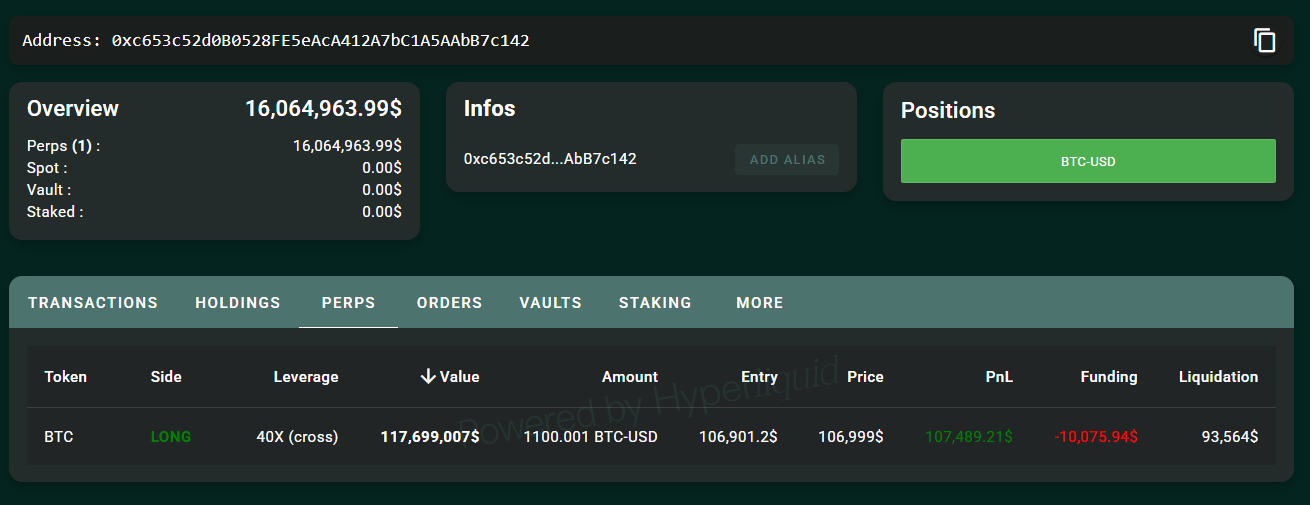

The second whale, 0xC653, entered at $106,901.2 and is currently up $107,490 to liquidate at $93,560.

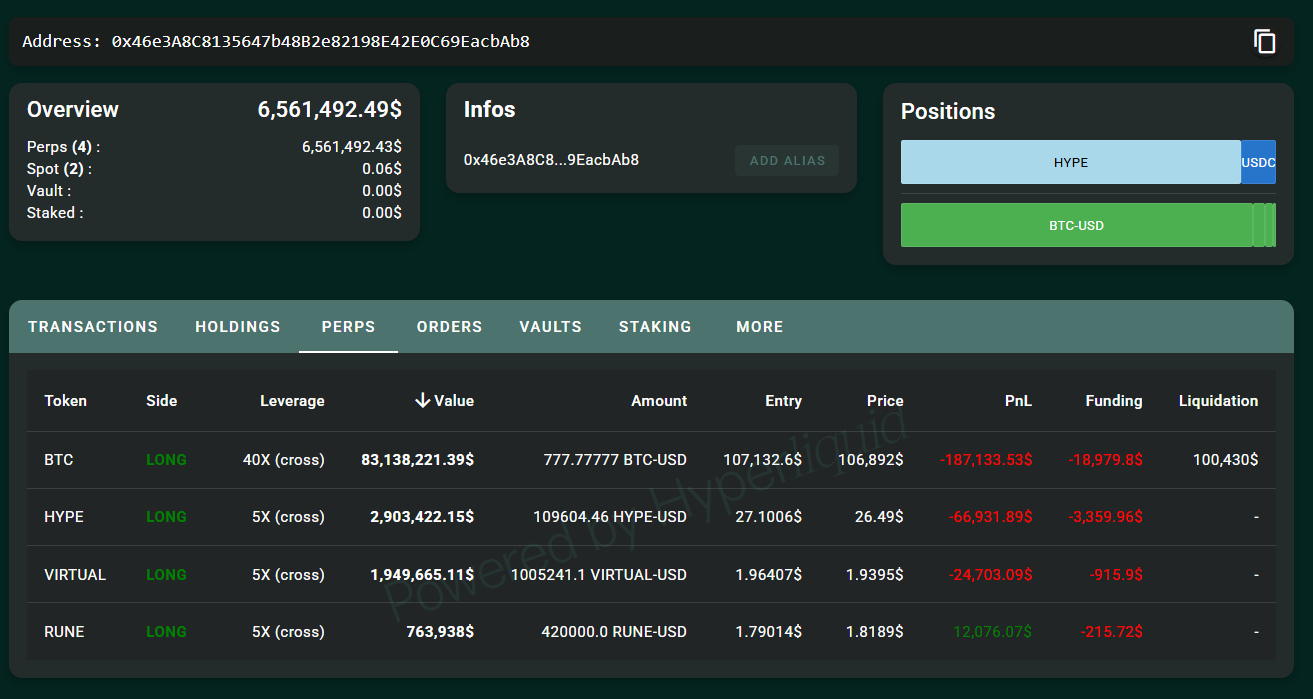

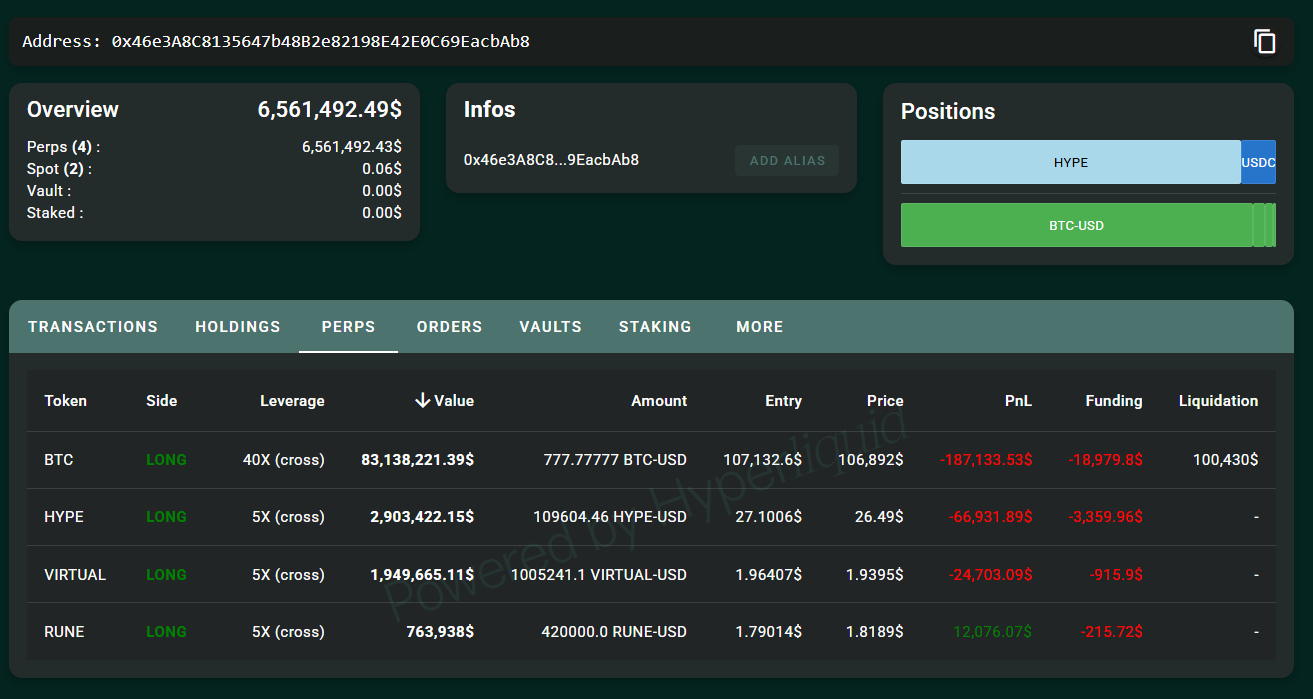

The third, 0x46E3, with a distance of $107,132.6, faces a loss of $142,800 and a liquidation price of $100,430.

These positions reflect a strong bullish outlook, although the risk of whales being liquidated due to leveraged trading is high, so whales’ prices have risen.

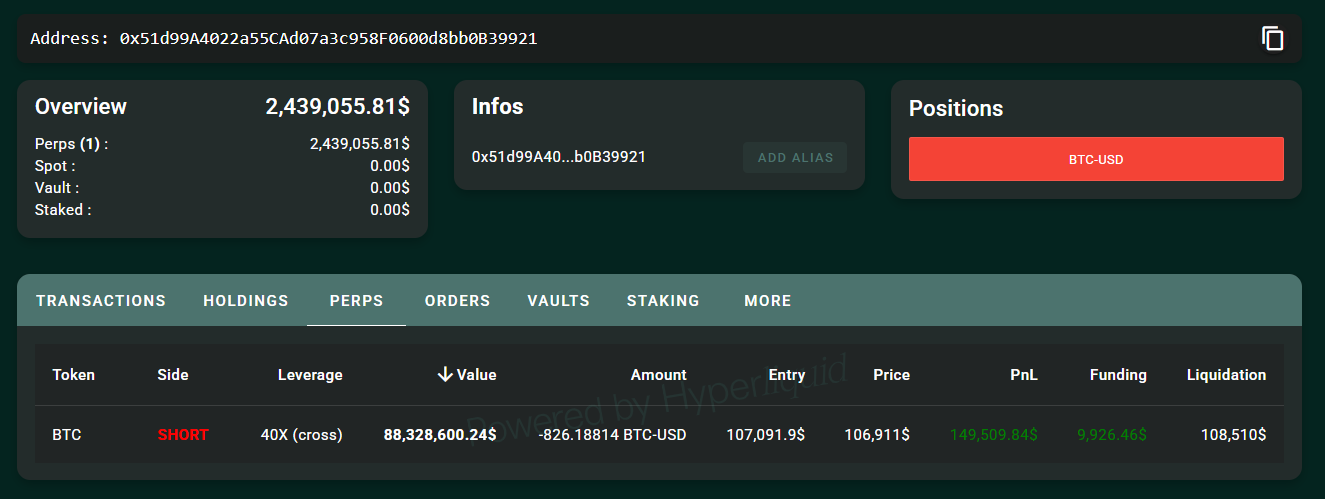

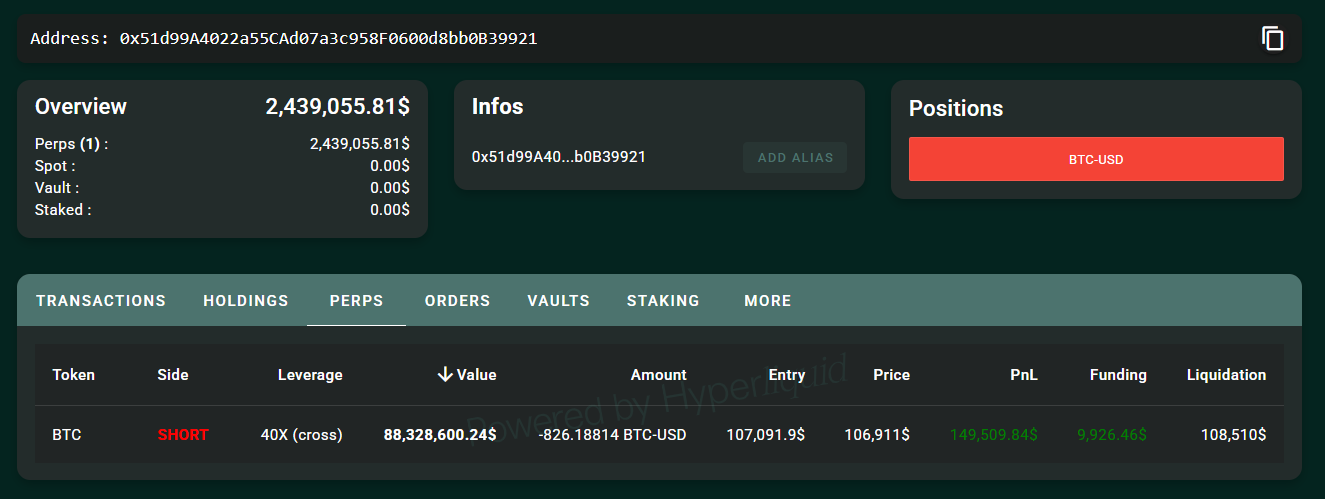

In contrast, lonely businessman 0x51d9 takes a bearish stance, short coins BTC The position is worth $107,091.9, worth $88 million and has a 40-fold leverage. The trader is currently up $149,509 with a liquidation price of $108,500.

These huge conflicts between long and short positions have created a billion-dollar showdown that has attracted the attention of the cryptocurrency community.

The use of 40x leverage (expanding the levels of gain and risk) shows that Bitcoin’s recent growth is strongly conviction. This can be interpreted as a bold prediction of a large number of price breakthroughs, which may be driven by their analysis of market trends, such as Bitcoin’s recent climb of more than $107,000 and growing adoption in institutions. Record inflows of Bitcoin and Ethereum ETFs and JPMorgan Chase’s position changes.

Additionally, some speculate that these whales may have access to internal information, such as upcoming regulatory developments or major marketing announcements. For example, in early 2025, a whale was levered Bitcoin and Ethereum’s long positionThe shutdown ahead of the U.S. cryptocurrency strategic reserve announcement has sparked doubts about insider trading. Although there is no direct evidence for this knowledge in this case, the timing fuels of these industries guess that these whales may know something and take action.

Encryption: There is no time to exit yet

Let’s study chain analysis to better understand future price movements of Bitcoin.

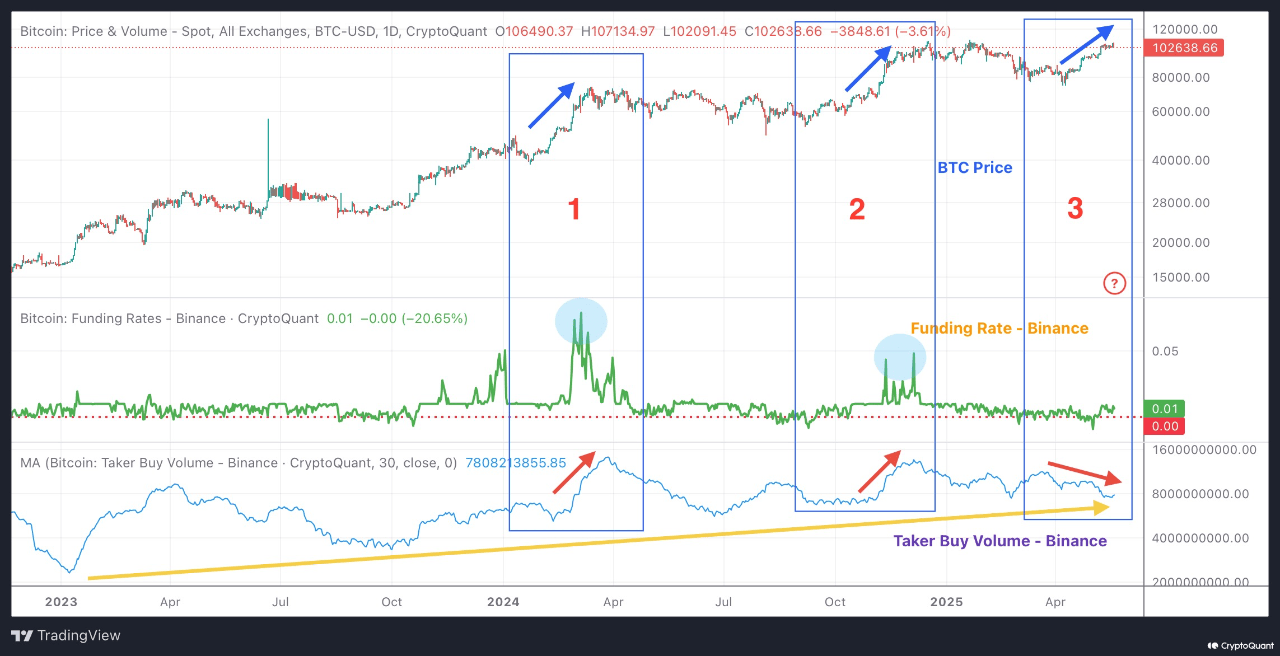

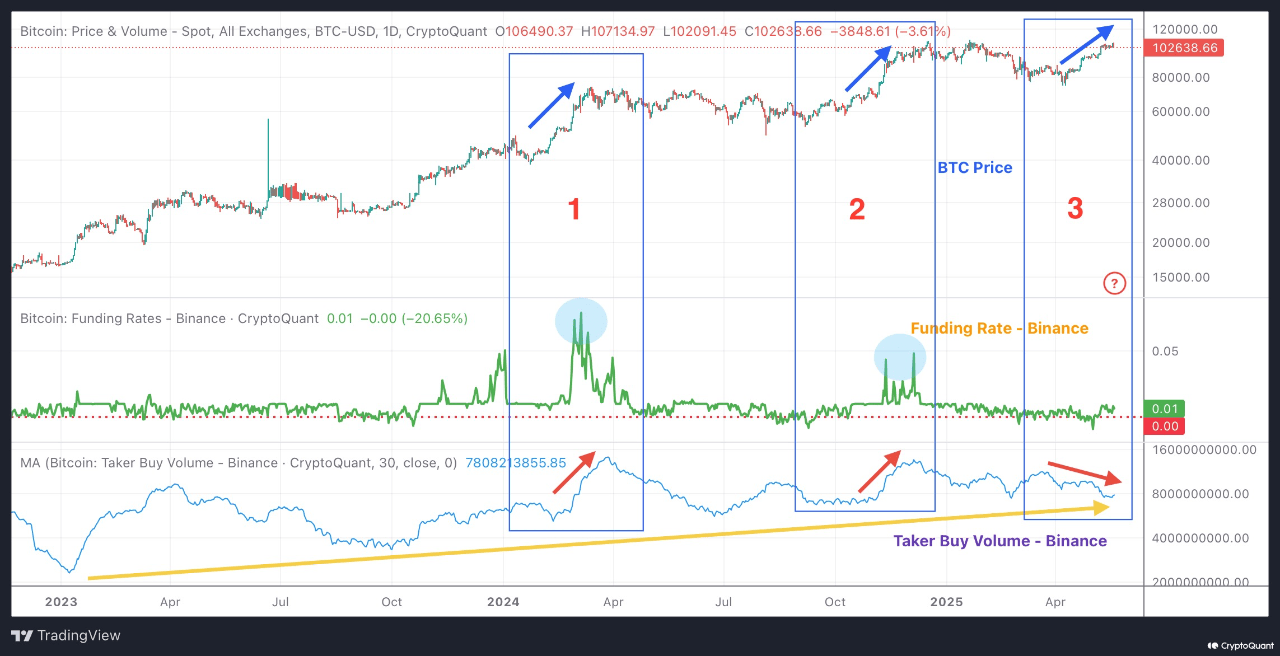

On May 20, 2025, CryptoQuant showed that Bitcoin’s recent price rebound is currently at $106,000, lacking signs of overheating, a positive indicator of a sustainable bull market.

Source: Encryption

encryption A recurring pattern highlighted in the Bitcoin price cycle: during this bull run, Bitcoin reached a new all-time high, with used coins recording sharp spikes in market purchases and fundraising speeds, and then corrected as the market overheated (Charts – Boxes 1 and 2).

These overheating phases resulted in extended corrections, during which time investors’ sentiment was weakened and many traders left the market. But as the market eased from lower sales pressure, Bitcoin eventually soared to new highs.

Now, since Bitcoin appears to be ready to break through its previous highs again after the recent correction, the pattern is quite different (Figure 3). Unlike previous rally, this rebound occurred without overheated funding rates, while binary market purchases are trending downward, indicating that the market is more cautious.

While some may think that falling buying volumes are a sign of weak momentum, Hidden Reptoquant believes it reflects healthier gatherings. They pointed out two key reasons:

First, the rapid overheating in the first two rallies triggered significant corrections, which suppressed emotions and shocked the weak hands. In contrast, the current “lightweight” market has moderate financing rates and low buying, indicating a more stable basis for growth, thus reducing the risk of a sharp decline.

Second, despite short-term volatility, the Binance Market Buy volume has shown a steady upward trend since 2023 (chart – yellow arrow), indicating a long-standing ongoing purchase interest.

This continued buying sentiment supports the case’s further upside, which suggests it’s not time to exit the market.

in conclusion

The positive length that whales occupy on the hyperliquid, with a total of 40 times leverage, reflecting their strong confidence in the bullish market outlook for Bitcoin. Coupled with CryptoQuant’s analysis, which highlights a healthier rally without overheating and ongoing long-term purchase interest since 2023, the data suggests that Bitcoin’s trajectory has a promising trajectory.

The whale’s bold bets and chain-bound indicators range from cryptocurrency points to expectations for sustained growth, and as long as market stability continues, Bitcoin may reach 115,000-$120,000 in the near term.