The Stablecoin market has witnessed a huge surge. These digital currencies are linked to stable assets like the US dollar. In 2024, they consolidated their position as the cornerstone of the Web3 economy. This growth emphasizes the utility of them more than just crypto transactions. They are now an integral part of payment, remittance and passive income strategies.

STABLECOINS ECLIPSE Traditional Payment: Transaction Volume Soars

Stablecoin The market continues its outstanding rise, firmly establishing itself as a key pillar of the Web3 economy. From 2024, the key highlight is the extraordinary $27.6 trillion in stable transfers, exceeding the combined transaction volume of visa and Mastercard. This huge shift underscores the increasing adoption of global payments by blockchain. This momentum continued into the first quarter of 2025, with steady transaction volume again superior to visas, with Ethereum’s 1st floor recording the height of Stablecoin volume in May 2025 at $480 billion.

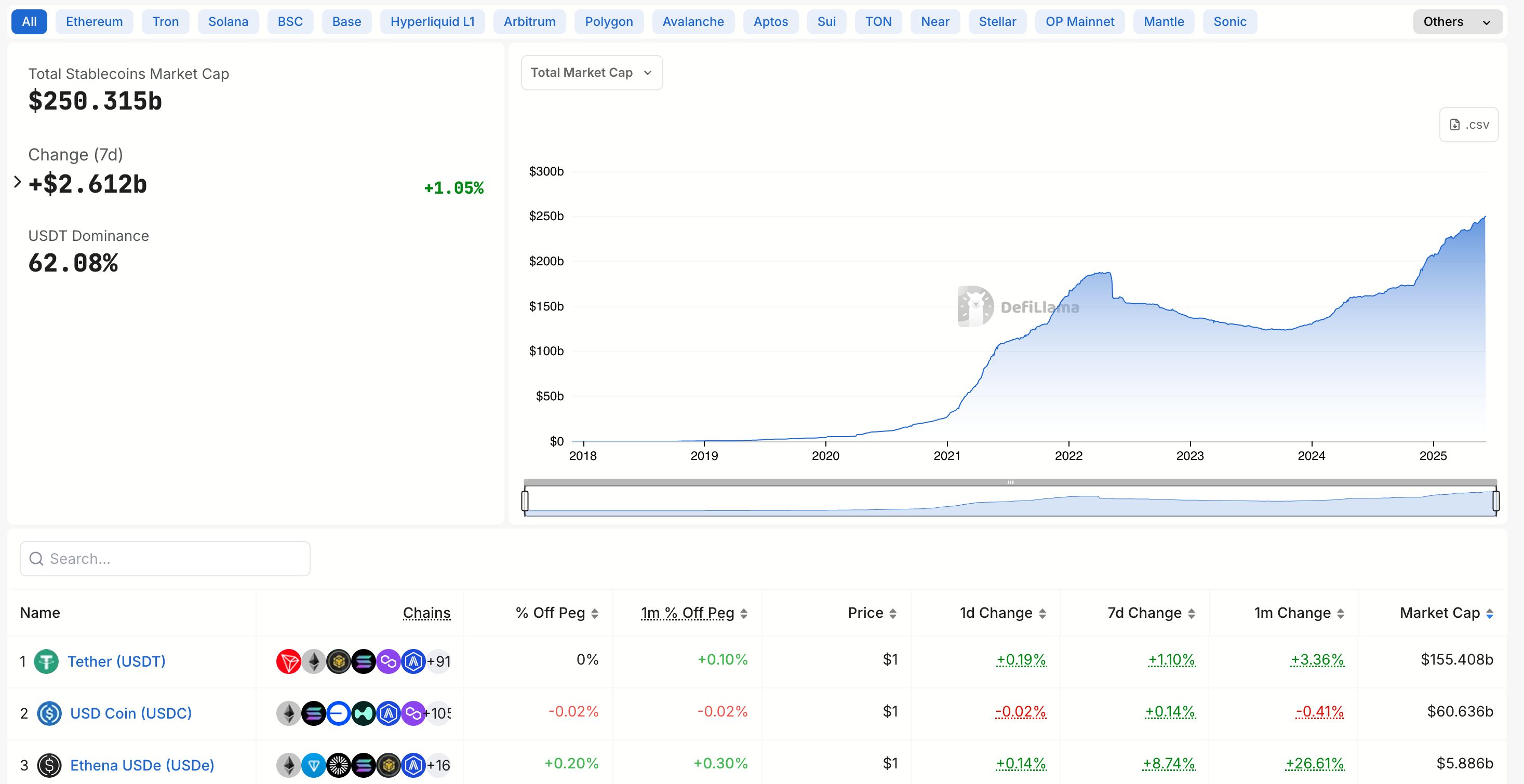

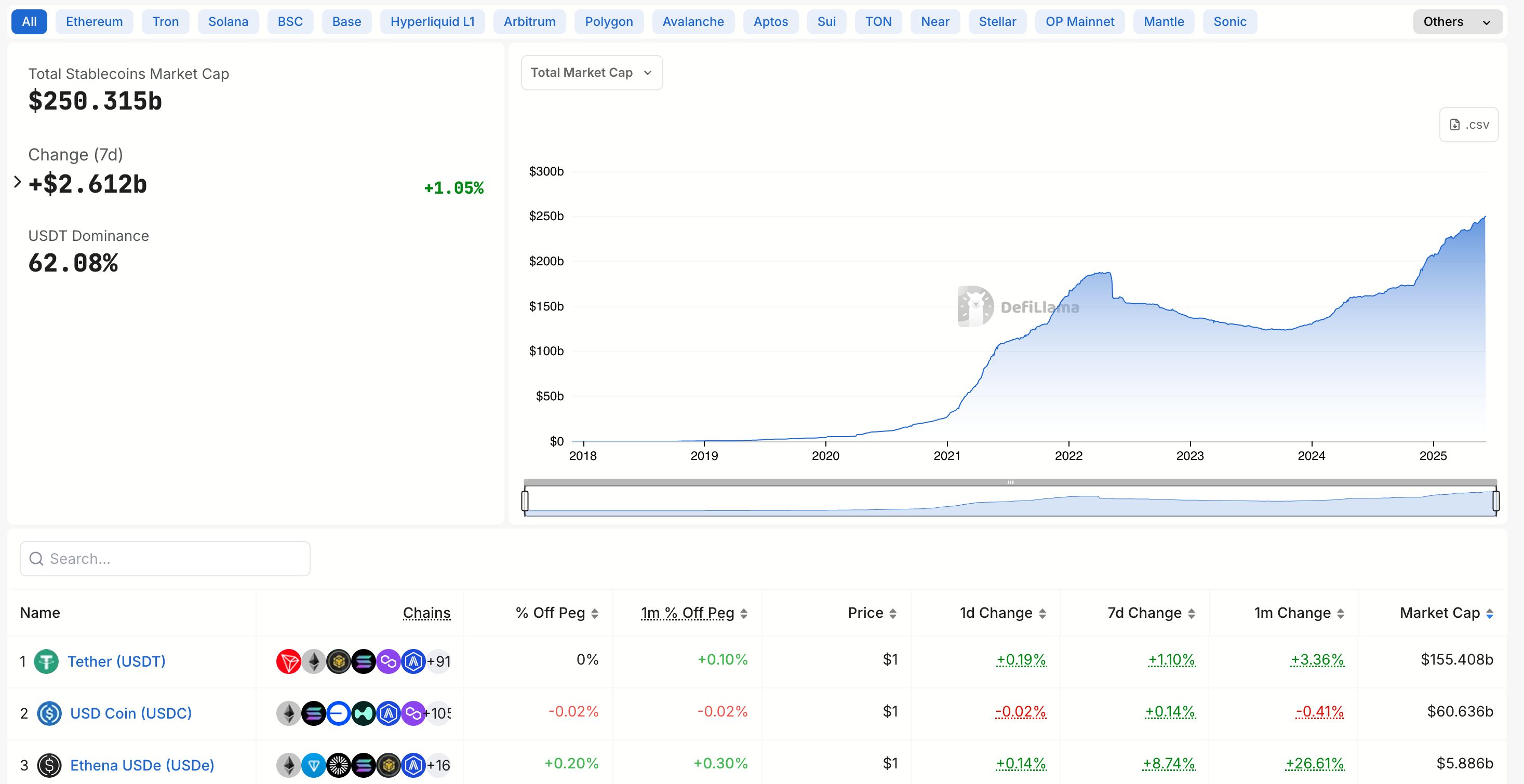

As of early June 2025, the overall stable market value totaled approximately US$250.3 billion. Tether (USDT) remains a market leader, worth approximately $15.3-15.4 billion, while Circle (USDC) showed strong growth, reaching $6.105-61.5 billion, with a focus on its focus on regulatory compliance. In addition to this competitive landscape, Ripple officially launched its USD-backed Stablecoin Rlusd on December 17, 2024, aiming to promote enterprise-level utilities for cross-border payments and position itself as a key player in the evolving digital financing field.

In addition to these major transaction stability, load-bearing stabilizers represent rapidly expanding sectors. By May 2025, their market value soared to $11 billion, now accounting for 4.5% of the total stable market. This growth is driven by important solutions such as Ethena’s USDE and real-world assets (RWAS), reflecting strong demand for passive revenues within DEFI. The evolving global regulatory landscape, including the implementation of mica and proposed U.S. legislation, will further accelerate mainstream and institutional adoption of all stable types, thereby enhancing its deeper integration into the global financial system.

Market share and advantages: USDT and USDC

The Stablecoin market remains largely dominated by the Two Giants (USDT) and Circle (USDC). As of early June 2025, Stablecoin’s total market value has reached approximately US$250.3 billion. These two stable stability accounts for approximately 86-90% of the total capital of the market capital.

- Tether (USDT): USDT maintains its leadership through market capitalization. As of early June 2025, its market value was approximately US$15.3-15.4 billion. Although Tether reported record profits in 2024, close to $14 billion (largely higher than its large U.S. fiscal bond holdings), its market share has declined slightly, now about 62.09% higher than last week in June 2025.

- Circle (USDC): USDC showed strong recovery and growth through 2024 and into 2025. Its market cap is approximately $61.05-61.5 billion as of June 5, 2025. Circle became the first MiCA-licensed stablecoin issuer in July 2024. This regulatory clarity is driving USDC’s adoption, particularly in regions with high remittance activity like Latin America and Southeast Asia.

Interestingly, although tethers dominate the entire market cap, data suggests that USDC has been attracting attention on certain networks. Some reports even show that by the end of 2024, USDC surpassed Stablecoin transaction volumes on networks such as Solana and Base.

A well-known new player who hopes to challenge the established order Ripple’s dollar-backed Stablecoin, Rlusd. Launched on December 17, 2024, Ripple has quickly begun integrating RLUSD into its cross-border payments solution, Ripple Payments.

As of early June 2025, RLUSD’s market capitalization was close to $380 million, an important beginning for new players. Ripple aims to position RLUSD as an “enterprise-level” and “compliance” option, leveraging its extensive network of financial institutions and existing relationships to facilitate effective cross-border payments.

The Dubai Financial Services Agency (DFSA) approved RLUSD in June 2025 to allow it to be used in Dubai’s financial free zone, further highlighting Ripple’s strategic focus in regulatory compliance and the real world as a potential challenger to the competitive StableCoin Landscape.

Source: Defillama

The rise of stability of load bearing stability

The stable market is currently witnessing explosive growth in carrying yield stabilization proteins. These innovative assets enable users to earn passive income directly from their stable digital holdings, leverage state-of-the-art procedures or support from real-world assets (RWAS). This shift is reshaping how investors view and utilize stable capital in the Web3 ecosystem.

By May 2025, the market value of these generated stable stocks soared sharply to over $11 billion in issuance, now accounting for 4.5% of the total Stablecoin market. This marks a $1.5 billion margin of just $1.5 billion in early 2024, with only 1% market share, highlighting their rapid adoption.

From February 2024 to February 2025, the total market value of these assets increased by more than 5284%. The main catalyst for this phenomenon is the emergence of protocols like Ethena, such as Ethena, whose USDE Asset alone only surpassed the $3.5 billion market cap at $3.5 billion in February 2025, and by February 2025, around $546 million in June, around $20.2 billion.

In addition, the expansion of the segment also exacerbated the market capitalization of tokenized fiscal bonds by 414%. This trend strongly underscores the growing interest in combining the stability of digital assets with the attractive returns achieved by traditional financial instruments, thus bridging the gap between traditional finance and the dynamic world of Defi.

An evolving landscape: networks and regulations

The Stablecoin landscape also sees changes in the preferred blockchain network. Ethereum and Tron’s dominance in hosting stability dropped from 90% to 83%. Networks like Basic, Solana, Indexes and APTO capture more of this share. This shift is partly due to reduced transaction fees for the second layer solution after Ethereum’s Dencun upgrade.

In addition, regulatory development continues to shape the market. The pursuit of clearer frameworks, such as the EU’s mica, is enhancing the legitimacy of Stablecoin. This clarity is crucial for wider institutional adoption. It also promotes the trust of traditional financial entities and governments.

The Stablecoin market showed strong growth and utilities growth in 2024. Their transaction volume is now comparable to traditional payment giants. While tethers and circles still dominate, the emergence of stable agents holding yield and transfer signal signals in network adoption are dynamic futures. Continued regulatory clarity will further promote its integration into the global financial system. CRCL and other investors in Stablecoin-related assets must closely monitor these trends.